Teaching Your Child Financial Literacy: Reasons and Resources

Financial literacy is a subject that needs constant discussions in order to impart new lessons at each age and stage in order to educate children about important life skills. It may not be essential to teach children how to write paper checks in the era of internet banking, but they must be educated on basics such as budgeting, the best approach to save for the future, and why it is crucial to saving rather than continuously spend.

Despite the fact that some schools include financial literacy classes in the classroom curriculum, it usually takes a second seat to teach the essential disciplines. The “one and done” approach to financial literacy does not offer the new generation of children the degree of information required to be successful adults.

Today, we’ll tell you about some of our favorite resources for teaching youngsters the fundamental financial skills they’ll need as independent individuals. Before we go into the resources for your kids, here are some compelling reasons to educate your child about financial literacy.

Reasons Why It is Important to Educate Children on Financial Literacy

It Teaches Children and Teenagers the Value of Money

You’ve undoubtedly told your children, “Money doesn’t grow on trees!” at least once. Unless your kid inherits a trust fund, they will almost certainly have to work for their money. While younger children may earn a few dollars for completing chores, by the time they reach their adolescent years, many children begin earning their own money by babysitting, mowing lawns, walking dogs, or doing other little occupations.

Teaching financial literacy lays the framework for wise money choices to be made today, which leads to better decisions with larger dividends later on.

It Teaches Teenagers How to Avoid Debt

Does the prospect of your kid going to the mall or buying online with a credit card in their name make you nervous? Talking about credit is essential for tweens and adolescents to understand the value of money and the repercussions of bad financial choices.

Instead of automatically saying “no” when your kid asks for a credit card, assist them to realize that it is not free money. Insist that credit cards be paid in full each month; otherwise, they will be charged interest, which may cost them considerably more than the initial purchase price—not to mention tying them into a debt cycle.

It is also important to teach your child what a credit history is and how to keep it in good condition so that the child does not have to use the services of credit score improvement companies to improve their financial situation.

It Teaches Kids the Distinction Between Necessities and Desires

As adults, we understand the distinction between what we need (food, shelter, clothes) and what we want (supersize lattes, a tropical vacation, the latest phone).

However, it is common for tweens and adolescents to mistake a need for a desire. You may assist children to learn how to balance needs and desires without getting into debt by educating them about money. Older kids may wish to go on a vacation with their friends, but with even a basic understanding of finance, they will recognize that this is a “desire” that they will need to budget for and save for.

Resources for Financial Education for Children

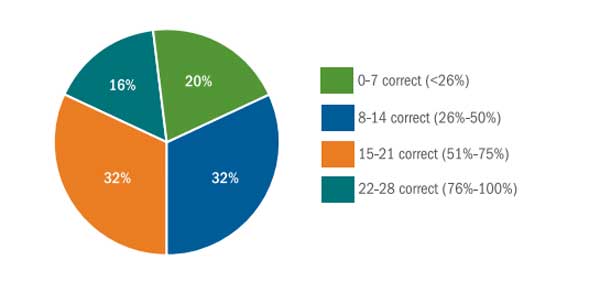

The IAA and GFLEC polled 1,043 persons and asked them 28 questions concerning everyday financial choices. These questions focused on saving, investing, borrowing, and earning money. The questions were meant to assess Americans’ understanding and management of money.

Adults in the United States are about divided 50/50 between those who properly answered one-half of the questions and those who did not. A shocking 20% of respondents correctly answered less than a quarter of the questions, demonstrating that Americans have a long way to go in terms of financial knowledge.

If you’re not great at financial literacy, but want the best for your child, you can use the resources below to get your child into the top 16 percent of financially literate and successful people.

The Venture Valley

The Singleton Foundation has just developed Venture Valley for younger children (and even those of us who are youthful at heart!). As they create and expand their own enterprises, children may use this online game to help them acquire financial literacy and business skills.

Players may play in either solo or multiplayer mode, and they can compete in online solo or team contests. Additional resources, such as classroom exercises and educator guides, may assist parents and instructors in building on the game’s contents.

Money as You Grow

The Consumer Financial Protection Bureau (CFPB) ensures that banks, lenders, and other financial institutions treat their customers fairly. The CFPB has established an online money platform for children. “Your child’s money milestones” enables parents to track their child’s progress toward completing financial milestones.

‘The Everything Kids’ Money Book: Earn It, Save It, and Watch It Grow!’

Is your child a reader rather than a podcast listener? Brette Sember’s Everything Kids’ Money Book is a terrific approach to teaching kids about the economy and how to be more responsible with their money.

The easy-to-navigate book, aimed at children aged 7 to 12, has pages describing how paper money is generated, how credit cards operate, and how stocks may help their money grow. Sember presents such hard issues in a style that is understandable to an elementary school audience, which is no easy task.

NextGen Personal Finance

The objective of the NGPF is to reform personal finance education in all schools in order to enhance the financial life of the next generation of Americans. They make it simple for instructors (and parents!) to engage pupils by delivering ready-to-use courses. Visit their Arcade for entertaining online games, interactives, and quizzes!

Comic Books Published by the Federal Reserve

A brave team of explorers journeys across the cosmos in search of—an investigation of monetary policy. This comic book series created by the Federal Reserve Bank of New York is not your typical action hero fare.

Still, the Fed deserves credit for teaching economic and financial ideas in a manner that children can understand. If it takes UFOs and four-eyed aliens to pique children’s interest in buying power or monetary policy, this is it. The series is primarily designed for instructors, although parents may receive a free download or even a printed copy from the Federal Reserve Bank of New York’s website.

Moneyskill

MoneySkill, created by the AFSA Education Foundation in 2002, was one of the first online personal finance courses. This service has grown to link educators and parents with resources meant to assist give tailored online courses focusing on the fundamentals of money management to students in middle school, high school, and college.

Students may engage in real-life simulations to put their new learning into practice, in addition to quizzes and pre- and post-course exam materials. There are 37 courses in all, with the ability to tailor the material to each student’s interests and learning requirements.

Conclusion

The sooner you start talking to your adolescent about financial literacy, the more robust and sheltered they’ll be from financial hardship. Finance knowledge will benefit your children throughout their lives and help them prepare for a prosperous future as financially responsible adults.