Guide to Navigate Financial Options for Ageing Relatives

“Waiting until a senior’s decline is evident may already be too late,”

- Ralph Bender

(Founder of Enduring Wealth Advisors in Temecula, California.)

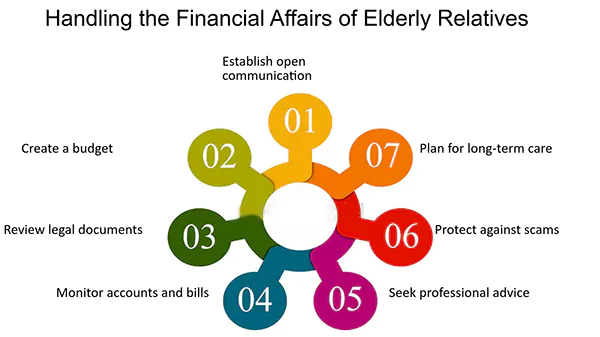

Your aging relatives need to be more mindful and need clarification about their financial management. What do you do? Well, I think it’s your turn to act as a caregiver for your aging parents and manage their day-to-day budget, overspending walk them through well-crafted financial planning.

One of the best ways to handle the finances of your relatives is to have a conversation with them while they are still working because as Ralph Bender mentioned,

“You should be talking to them about it while they’re still working because they’re still competent and still able to fund [long-term care] and pay the premiums from income,”

And I know there might be many questions arriving in your mind right now such as how can you protect their financial security and what’s the best way to handle unexpected expenses.

Well, worry not because in this read we are going to delve deeper into the intricacies of key financial considerations for aging relatives in the UK, along with available options and resources.

Let’s start!

Understanding Pensions and Retirement Income

In layman’s language, a pension pays you regular income to live on after your retirement. It is one of the most tax-efficient ways to save for retirement and is a vital source of income for many retirees in the UK.

There are different types of Pensions including:

- State pension: Under the Pension Act of 2008, an employer must ‘qualifying workplace pension scheme’ and enroll all potential employees into the scheme. It’s available to people who have reached the current qualifying age and have made sufficient National Insurance contributions.

- Workplace pension: This is offered by employers, and involves employee and employer contributions, where funds are invested in a pension scheme.

- Private pensions: Private or self-invested personal pensions (SIPPs) are financial plans where individuals privately contribute from their earnings, which will pay them a pension after retirement.

Exploring Benefits and Financial Assistance

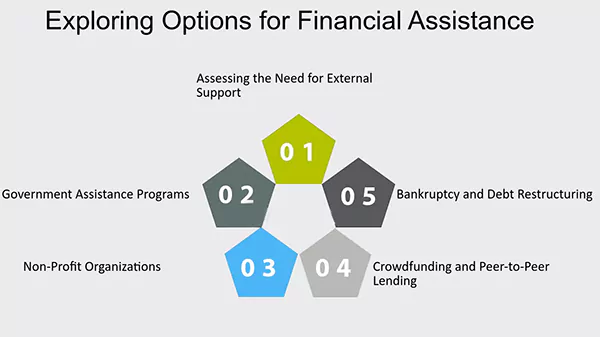

Managing finances can be a major stressful activity to deal with but there is help out there to lighten the burden out of your busy schedule.

Financial assistance brings striking benefits such as Attendance Allowance, Disability Living Allowance (DLA), Personal Independence Payment (PIP), Housing Benefit, Council Tax Reduction, and Pension Credit.

And if you need emergency financial assistance there are several options such as:

• Money Advice Service: It offers advice on how to help improve your finances, tools, or calculators to help in planning and support over the phone and online.

• Budgeting Loan / Budgeting Advance: Providing a short-term interest-free budgeting loan that can be used to buy essential items but must be paid back.

• Universal Credit: UC is a single monthly benefit payment for working-age people offering financial support to low-income or out-of-work individuals.

• Local Welfare Assistance: It provides financial support to low-income people, which is administered by local authorities.

• Tax repayment: If you are unable to pay your taxes in one go, His Majesty’s Revenue & Customs (HMRC) may accept your approval to set up a payment plan to pay your taxes in installments.

Planning for Long-Term Care Costs

According to a 2020 report by AARP, only one out of five is a caregiver in the U.S., which demonstrates how many retirees need financial assistance.

Many people believe that long-term care planning is traditional insurance and despite knowing that it is an indispensable need very few retirees have a plan.

Long-term care options include home care services, assisted living fasciitis, and residential care homes. However, its cost can be affected by multiple factors such as required care, quality of the facilities, and most importantly the location.

For instance, If you are planning to move U.S. with your family then getting Austin Texas memory care will be more relevant Then getting one back in your hometown.

This is why it is essential to consider potential costs when crafting a perfect financial plan for your aging relatives and explore funding care options such as savings, investments, equity release schemes, and insurance.

Did You Know?

According to the U.S. Department of Health and Human Services, 70% of senior citizens require long-term care at some point.

Seeking Financial Advice and Support

Financial planning can be a daunting and stressful activity, especially if you are doing it for someone else (in this case your aging relatives), which is why it is recommended to seek professional advice and support.

An Independent financial advisor (IFA) can not only help you build wealth and fulfill your goals but also walk you through the immense knowledge and tips in your investment journey.

Several organizations such as Age UK, are working closely to navigate you through the complexities of pensions, benefits, and long-term care planning while providing support resources.

Conclusion

In closing, by having a clear understanding of the financial options you can craft a perfect plan for your aging relatives while securing a stable income after their retirement.

There you have it your comprehensive guide to the available options for well-crafted financial planning. Hope it helps.

Thanks for reading!