A Beginner’s Guide to Start Investing Smartly

The art of saving and investing money smartly may seem complex for a beginner. However, just like any skill, handling funds can be learned through focus and research.

Assistance is always required for understanding the stocks, market volatility, mutual funds, types of loans, etc.

Creating an investment portfolio isn’t enough and to help beginners start confidently is financial education.

It doesn’t matter at what age you want to learn, with platforms like the Yuan Mastery Website, the path to investment education becomes easier.

This article is a perfect beginner’s guide on how to start investing smartly and its benefits to navigate the risks confidently and make profits for a secure future.

What is Smart Investment?

Do you want to see your money grow? Then smart investment is your answer. It isn’t a one-stop solution but a continuous learning process that depends a lot on your financial goals.

Before even making your portfolio, you should be clear about how much money you want to invest and why.

Laying a secure foundation for your account is by making an investment strategy and assessing risk factors.

Smart investment is also about making informed decisions through patience and research before getting attracted to the highest market value.

DO YOU KNOW?

Berkshire Hathaway is the world’s costliest stock. One share of the company costs you over Rs 2 crore.

How to Start Investing Smartly?

There are several opportunities to invest smartly like bonds, cryptocurrencies, real estate, and more.

As a beginner, starting with a plan is in itself an overwhelming task because your basic needs should align with your future growth timeline.

Here are the best methods to help you begin with an investment plan that will give you a strong start in handling your funds efficiently.

Start Early Investments

We all learn about profit and returns in the school but handling finances is much more than that. Starting to invest early is the best bet to understand how the money moves from one position to another.

When you begin investing as soon as possible, your compound earnings begin to flow immediately.

You can start as an investor with a small amount with no minimum investment, zero commissions, and fractional shares.

This includes index funds, exchange-traded funds, and mutual funds. You may face occasional setbacks but starting investing at a young age will give you enough years to experiment and get back on track.

To assess your financial situation clearly, connecting to experts through investment education platforms is always helpful.

FUN FACT

Warren Buffet, one of the world’s most successful investors started investing at the age of 11 and filed his taxes for the first time when he was 13.

Invest Consistently and Patiently

Investing isn’t for those who want to have a stable money inflow because to grow money means to take consistent risks.

According to your financial goal, invest every month or quarterly to maintain a disciplined investor portfolio.

The longer you stay in the market patiently assessing every company and trade, even if it’s only for a small amount, it will bear better returns.

Diversify Your Portfolio

Your asset could be in mutual funds, real estate, or gold, it is always advised not to put all your money at once.

Risk factors will always be there even during a strong and stable economy. Diversifying your assets lowers the risk factor during sudden market downfall by having a backup setup.

The intention is also to benefit from other assets while continuing to invest in small or large ones.

Take Calculated Risks

The biggest mistake often new investors make is to sell their shares on the first hint of downfall. In fact, a strong long-term company’s stocks always rise quickly as well.

People who stay patient and remain committed to such a company always profit more during market fluctuations. This is one example of taking calculated risks.

Many government-backed schemes could also defer heavy losses and handling funds should always be based on maintaining low risks and steady investments.

Track Investment Market Regularly

Opening an investment account like a brokerage account is way better than using your savings one.

In this way, whenever a company issues bonds or stocks, investigate their past records and enquire from financial experts, before investing in it.

Thus, tracking the investment market regularly comes in handy whenever a new trading option appears.

Also, your invested amount should be aligned with your needs instead of suggestions that seem to be more profitable.

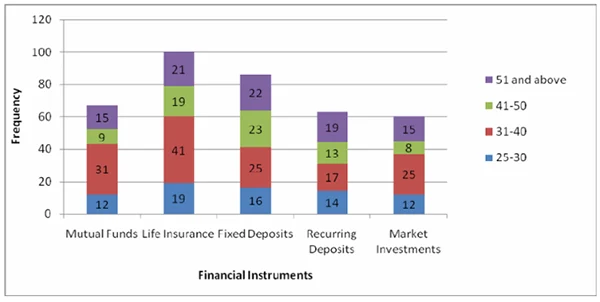

Take a look at the graph below, that shows the number of people of different age groups investing in different avenues.

Benefits of Investment Education

The more you learn about investing your money smartly, the easier it is to understand and adapt strategies that work for you.

When you start educating yourself about market research, you build a personal financial plan and can rise above heavy losses.

- Investment education prepares you to make the first investment in the right direction confidently.

- It familiarises you with the necessary tools or investment options that are most suitable for your financial scenario.

- All the doubts regarding risks involved in investment become clear.

- You don’t feel isolated with an expert financial advisor by your side.

- You can frame a personalized investment strategy and make independent decisions.

- It helps you generate expected results and defer heavy losses.

- You build relevant experience along with a regular backup plan.

Conclusion

Having a secure future that is not solely dependent on your savings is being open to varied investment opportunities.

It starts with setting a short-term goal that fulfills all your current needs and a long-term financial goal that takes care of your family.

With the suggestions mentioned in this article and learning about different investment options, beginners can start investing confidently.