5 Reasons Why You Should Learn About Investing

Hey, it’s 2024 and by now we all know that investing is a pretty awesome way to build your wealth over time.

It’s a way to make your money work for you.

While holding cash and bank savings can be a safe bet to save and get interested, investing allows it to grow in value over time, and the best part is that the value of investment compounds, which is good if you want to save up for your long-term goals.

That brings us back to the question, Why do you need to learn about investing?

No matter what you invest in, be it stocks, mutual funds, bonds, futures, real estate, or small businesses, all investments are pretty much dependent on the market.

While they may help you build wealth in the long term, the short-term benefits of investing can be risky.

You need to better understand what investments are, their types, and how to safely invest in them.

In this blog post, we will discuss some reasons why you should learn about investing.

And if you want to learn more in-depth about the world of investments, then go matrixator.com might be able to help you.

DID YOU KNOW?

Based on US stock market data from 1871 to 2012 (analyzed by Morgan Housel of MotleyFool), if you hold stocks for one year, you have a 68% chance of making money. Make it 5 years and your chances go up to 80%. And over a 20-year period? 100%.

5 Reasons to Learn About Investing

While they can be risky, they can also act as a safety net for your future.

Here are some reasons you need to start learning about investing:

1. You Get Better Returns Than Your Savings

We all know that investing can give you much higher returns than your bank’s savings account.

While there might be some ups and downs because of the stock market, over time you might even be able to save enough to beat inflation.

2. You Can Diversify Your Assets

You’ve probably heard of the saying, don’t put all your eggs in one basket, the same can be said for investments too.

Putting all your money into a single investment can be very risky.

They depend on the market to grow.

You need to learn why diversifying your investments can help you have a safety net in case one of your investments fails.

After all, you need to be able to protect your money if you want to achieve your financial goals.

3. Mistakes Can Cost You A Lot

The world of financial markets can be risky.

You need to understand the flow of the market before you even start your investment journey.

A small mistake here can make you lose all your fortune.

The most important thing you need to keep in mind is that it is easy to learn about investment and you can easily go to online teaching services like matrixator.com to begin your journey into the world of finances.

4. It Can Help You Save on Taxes

Taxes have become a part of our everyday lives these days.

We pay taxes for pretty much everything, from groceries to even the fuel in our cars are taxed.

But, is there any way to save up on these taxes?

Well, you’re in luck because investments are a great way to save out on your taxes.

Depending on where you live, when you invest for the long term, your capital gains taxes would come out to about 15-20%.

This is much less than what you would have paid if you had just been working.

Besides, if you have made any recent investments, you can show them off as expenses as well.

And, the best part is that if any of your investments are at a loss, you can deduct the losses from your taxes too.

5. You Can Beat Inflation

We all know for a fact that inflation sucks and we all hate it.

The prices of things go up and our salary cannot keep up with the expenses.

And if you look at the recent prices, it’s easy to see that inflation has been making the prices of things go up about 3 percent every year.

This means that no matter how much interest the banks give you in your savings account, it will never be able to keep up with inflation.

So, how do you actually beat the inflation?

If you had actually learned about investing, you’d know that you’d earn about 8-9% on your annual returns or more with your investments.

This gives you a 4-5% head start on inflation.

And, the best part is that your investments will compound (gain value) over time.

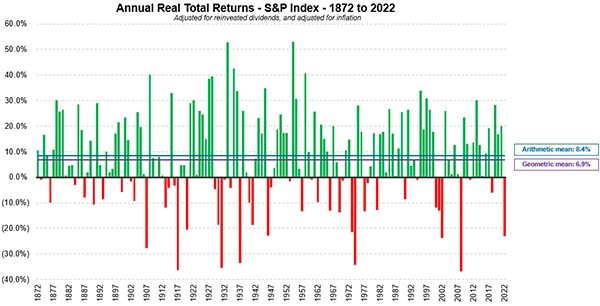

The U.S. stock market has generally trended upwards over time (6.9% per year after inflation and including dividends) from 1872 to 2022, The market from year to year can be volatile. In this time frame, the market has grown in 69% of the years and declined in 31% of the years on record. (with 5 cases of declines by 30 to 40% in a year).

Conclusion

It’s never too late to start learning about investing, it is a great way to build your wealth over time.

There are many more benefits to investments than just higher returns from savings accounts.

But, since investments are dependent on the financial market for their growth and value, they can be risky as well.

You need to understand what investments are and how you can use them to save for your long-term goals.