Ethereum to Outperform Bitcoin as Investors Shift Their Attention to Altcoins

The cryptocurrency market has been going through troubles for quite some time now, and it seems like it will still be a while until it recovers completely. Back in 2022, the market experienced severe pricing plunges, which dropped the value of digital finance assets and tokens so low that many began considering abandoning the market altogether.

For those that prevailed, things started looking up towards the beginning of 2023. Since then, Ethereum has grown quite a lot, leading investors to feel secure about their investments again. Binance data shows a shift that the difference in the Ethereum price brought.

Unfortunately, this wasn’t to last, as regulatory pressures, as well as macroeconomic concerns, caused trouble among marketplace participants. While prices didn’t start dropping right away, they stagnated and drove the market to remain uncertain.

Now, after more than half of 2023 has passed, it’s time to have a look at the crypto environment movements that will likely affect the prices during the last months of the year.

Outperforming BTC

The rivalry between Ethereum and Bitcoin is well-known. While the former is famous as the most preferred altcoin in the world and a pioneer in decentralized innovation by introducing concepts such as DeFi and Dapps, the latter is the blueprint for all cryptocurrencies, the original digital coin.

Over the years, Bitcoin earned the nickname “digital gold” due to its ability to maintain value over a long time and protect holders against the harmful effects of inflationary pressures.

BTC has by far the highest market capitalization in the crypto environment, yet it has also been impacted by the negative trends that are leaving its mark on the marketplace lately. That has led some to speculate that Ethereum might soon dethrone Bitcoin and establish its own dominance.

But these speculations are nothing new.

Bitcoin delivered 83% growth since the beginning of the year, far superior to any other coin or token. However, ETH still positioned itself solidly, with a performance growth of almost 60%.

According to data, the Bitcoin dominance has declined over the past two months as investors shifted their focus to altcoins. A persistent downtrend indicated a shift in market sentiments worldwide, and should it persist, it could mean that Ethereum could outpace Bitcoin in the near future.

Bullish Reversal

The crypto market has been somewhat uncertain over the past months, and Ethereum is no exception. During this time, many investors have entirely switched to holding and long-term investing instead of focusing on any kind of speculation.

This has protected them from incurring further flops. At the other end of the spectrum, however, are the short-term holders. This cohort has lost tremendously, and it’s likely that the losses will continue to mount.

However, others are more optimistic, believing that the recent price shift is nothing more than proof that Ethereum will soon enter a recovery zone. The current oversold status could show that

Ethereum entered a bullish reversal during the first days of September. Since it is the most popular altcoin on the market, it will likely be the coin that manages to outpace Bitcoin.

Price Consolidation

It’s likely that the price point will experience more resilience over the following months and be better equipped to handle market changes as well. Around 5.11 million investors purchased approximately 7.04 million Ethereum coins for an average price of $1,850.

This group has the potential to offer considerable support, especially if it continues to focus on altcoin marketplaces.

DID YOU KNOW?

The first Altcoin was Namecoin, developed based on the codes of Bitcoin in April 2011.

However, if the bears manage to push past the resistance level, the price of Ethereum could potentially drop under $1,500. That would be the lowest level that Ethereum has recorded in March 2023.

A reversal to values recorded approximately six months before would mean considerable losses for the market, especially considering all the growth the environment has managed to secure since then.

There’s also the possibility that bulls could seize the momentum, leading to a rebound towards $2,000 or above. 6.65 million users purchased 6.14 million ETH coins for the maximum price of $1,900. If they go for this position, the price might retrace.

Retail Addresses

While Ethereum has been navigating a bearish episode since the second week of July, and the mid-August dip deepened the trend, it’s clear that users haven’t necessarily lost their interest in the market.

It appears now that accumulation is becoming very pivotal for the market. Interestingly, the number of retail addresses has been steadily growing to the current levels. The number of wallets holding at least ten Ethereum coins has reached a new 40-week high.

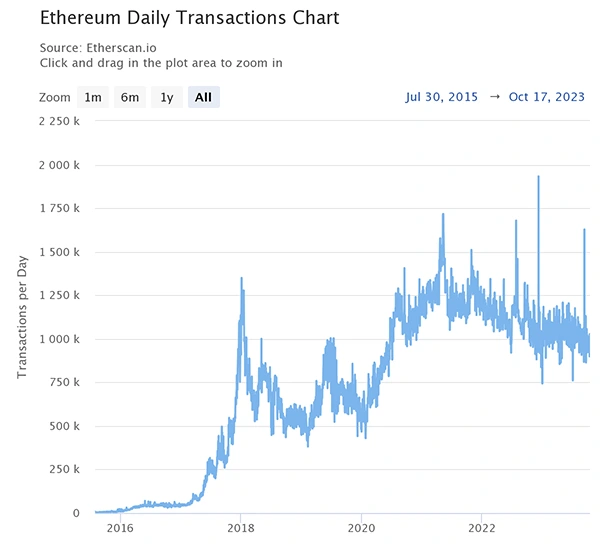

This clearly shows that investors have been regaining their faith in the market. A further indication of this sentiment is that Ethereum has been leaving exchanges. The balances fell to a multi-year low recently, with the last time the exchanges were at this level being in 2016.

However, this is good news for a long-term bullish outlook since it confirms a long-term bias.

Yet, the accumulation isn’t enough to support a rally, meaning that bulls must still wait for more favorable conditions to develop. The fact that the environment remains uncertain plays a prominent role in the current situation.

Investors are reasonably concerned that the marketplace will continue on a downside trend. Given the continuous discussions surrounding the higher interest rates in the United States, it’s no surprise that the overarching strategy seems simple: protecting your portfolio and holdings no matter what.

The Bottom Line

While the cryptocurrency environment has shown that it can be pretty resilient, managing to recover quite a lot in the aftermath of the heavy bear market of 2022, it will still be a while until it regains its full strength.

Those who trade on the blockchain are still apprehensive about the future yet remain convinced of the potential digital coins have to change not just the financial environment but the world itself.

Nonetheless, it’s important to remember that extra caution is needed during difficult times in order to protect your assets. Anything else can see you recording more losses than gains, and this is something that no investor wants to deal with, which is why remaining attentive is paramount.