Crypto Guide for 2024: The Main Points that You Need to Know About Cryptocurrencies Before Invest

The dawn of the 21st century brought with it an innovation that promises to redefine the financial landscapes of our times: cryptocurrencies. As we stand in 2024, these digital assets, once a niche technological experiment, have burgeoned into a formidable financial force, making it imperative for potential investors to arm themselves with knowledge before diving in.

Understanding the Basics of Cryptocurrency

At its core, people are accepting cryptocurrency as a decentralized digital or virtual currency based on blockchain technology. Unlike traditional fiat currencies issued and regulated by governments, cryptocurrencies operate on a decentralized ledger, free from central authority or intermediaries.

This decentralized nature, when offering a degree of transparency and security, also introduces a new set of dynamics, especially speaking of market behavior and value determination.

The Volatile Nature of Cryptocurrency Markets

Anyone who has observed the crypto markets even briefly can attest to its volatile nature. Prices of cryptocurrencies can surge or plummet dramatically within short time frames. This volatility is influenced by a myriad of factors, including technological advancements, adoption rates, regulatory news, macroeconomic trends, and, quite significantly, market sentiment driven by news and social media.

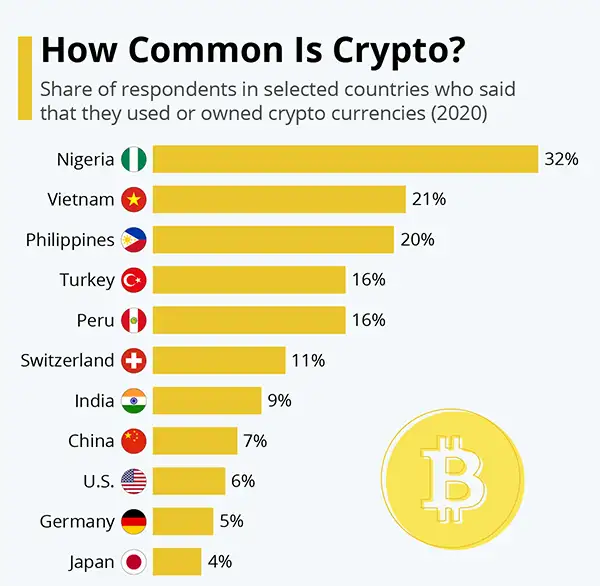

Fun Fact

This graph from Statista shows the countries where investing in cryptocurrencies is the most common. Here you can see that Nigeria ranks at #1, followed by Vietnam and the Philippines.

Importance of Research and Due Diligence

Given the complex interplay of factors determining the prices, it’s paramount for potential investors to conduct thorough research before committing their funds.

Delving deep into a cryptocurrency’s fundamentals, understanding the team behind it, its real-world applications, technological underpinnings, and the problems it seeks to solve can provide clarity.

Moreover, platforms like CoinMarketCap, CoinGecko, and various crypto-centric forums can offer insights but always approach such information without bias, filtering out noise from genuine analysis.

Diversifying Your Crypto Portfolio

Drawing from traditional investment wisdom, it’s rarely wise to put all your eggs in one basket. The crypto world, with its thousands of tokens and coins, offers ample opportunities to diversify.

Whereas Bitcoin remains a dominant force, several altcoins have carved out their niches, offering unique use cases and technologies.

By diversifying investments across a range of cryptocurrencies, investors can potentially mitigate risks associated with the underperformance of a single asset.

Security First: Safeguarding Your Investments

Crypto investments, unlike traditionally banked assets, come with a set of security challenges. The decentralized nature, when eliminating intermediaries, also places the onus of security squarely on the investor.

To store cryptocurrency safely, you must understand the difference between hot wallets (internet-connected) and cold storage solutions (offline storage) becomes decisive. Whereas hot wallets offer convenience, they are susceptible to online threats. Cold storage, on the other hand, provides a higher degree of security against digital threats.

As the ecosystem has matured, it has given birth to a plethora of platforms catering to various needs, from trading to staking, lending, and more. One such platform that has garnered attention is Klever.

Offering a range of services, klever emphasizes a user-friendly approach, ensuring that even those new to the crypto world can navigate with ease. Recognizing and utilizing platforms like Klever can significantly enhance one’s journey.

Regulatory Landscape and Compliance

The relationship between cryptocurrencies and regulatory bodies has always been dynamic. As governments and financial institutions grapple with the implications of decentralized currencies, regulations can shift.

For investors, staying abreast of the regulatory landscape in their respective regions is vital. Ensuring compliance not only safeguards one’s investments but also contributes to the broader legitimacy of the crypto space.

Every investment avenue comes with its risks, and cryptocurrencies are no exception. Beyond market volatility, potential investors should be aware of risks like regulatory crackdowns, technological vulnerabilities in a particular blockchain, and liquidity concerns.

Having a well-thought-out risk management strategy, which might include setting stop-loss orders and only investing what one can afford to lose, can offer some protection against adverse market movements.

Despite the risks, the allure of cryptocurrencies remains undeniable. They promise a future where financial systems are more transparent, inclusive, and free from monopolistic control. For us from waybinary, the potential for high returns, coupled with the revolutionary tech behind it, makes cryptocurrencies a captivating investment frontier.

In conclusion, the world of cryptocurrencies in 2024 offers a blend of immense potential and significant risks. As with any investment, knowledge remains your most potent tool. Equip yourself, stay updated, and may your crypto journey be both exciting and rewarding.