Stocks Versus Index Funds: What’s Best for Your Investment Strategy?

In Australia and, indeed, in most advanced economies, there has been a boom in retail investing and trading that shows no signs of slowing down. The trend is all the more interesting due to the fact it takes out the middleman. Sure, retail traders and investors will use online brokers to facilitate their transactions, but in essence, it is just you versus the market.

There are, of course, many options for investment and countless ways that you can trade financial assets. Yet, one of the most fundamental questions, particularly for first-time investors, is whether to invest in individual stocks or an index fund.

Stock Trading

As most are aware, share trading involves the buying and selling of company shares. They may be stocks listed on the Australian Securities Exchange (ASX) or other national share exchanges like the New York Stock Exchange (NYSE) or London Stock Exchange (LSE). The best online brokers will give you round-the-clock access to them from the biggest companies in the world.

You can look at it in two ways in terms of strategy: You can buy and hold certain shares as an investment, or you can choose to trade. Both carry risk, of course. The former option is usually a long-term strategy, whereas the latter is more short-term. It’s worth remembering that traders can make money in both directions, even if they are trending downwards.

Stock Market Indices

An equity market index is essentially a basket of shares, normally categorized into groups by performance or sector. For instance, one of the best ways to understand indices is by looking at the ASX 200, which is an index for the top 200 largest public companies in Australia.

Other vital indices include the S&P 500, which lists the top 500 public companies on US shares exchanges, and the FTSE 100, which has the top 100 companies on the London Stock Exchange. An index can also be a group of the biggest shares from a specific industry or sector, such as technology or oil.

As with individual equities, there are two types of strategy for indices: investing or trading. Again, both are risky, as with any investment or trade, yet investing in it over the long term is usually seen as one of the safest long-term strategies. That fact is one of the decisive drivers of investing in it, and it forms part of the argument when choosing between shares and indices.

Stocks vs. Indices

It should be apparent from the above that investing in them involves backing the performance of an individual company or companies, whereas indices investing means tracking the investing in the performance of the wider equity market.

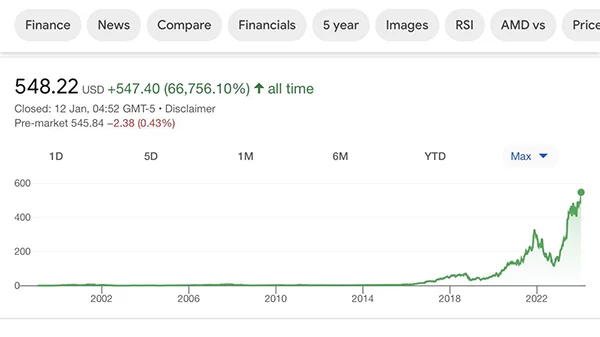

We can show an example chart here with Nvidia, arguably the hottest share of 2023.

Nvidia, which is listed on the NYSE and was the biggest gainer of the S&P 500 in 2023, was the talk of the town last year. Its rise in value catapulted it into becoming one of the most valuable companies in the world.

When the stock started to rise in the late 2010s, it was the AI boom and demand for GPU that sent it into the stratosphere last year. Those holding them from the early 2000s would have been richly rewarded with many multiples of their initial investment.

The next chart we will look at is an index, specifically the AU200. The chart below shows the performance of the index over the 21st century. As you can see, it rode up before a steep decline (coinciding with the Global Financial Crisis of 2008.

It took some years for the AU200 to recover – more than a decade to recover. But once it did, despite a big drop during the early days of the COVID-19 pandemic, it motored on to new all-time highs.

So what, then, can we learn from the two charts above? The first lesson is that buying an individual stock can lead to impressive gains over a relatively short period. Investing in indices is something that you might consider over a much longer timeframe, decades perhaps.

One of the main attractions of indices is that by and large, they will rise over time. They will rise and fall, sure, but the trend is almost always upward. Investors can have relative confidence that, over time, their investment will rise in value. They may have to adjust that investment – consider that drop in 2008 – but you can be generally confident that it will rise in value.

Yet, some investors will see individual shares as winners. Indeed, it’s difficult not to be attracted to shares like Nvidia, as well as other superstars of the 2020s, such as Tesla. Yet, consider that over time, the leaders change. In the 1990s, the Fortune 500 was led by companies like General Motors and Ford. Today, Ford’s stock is worth about one-third of what it was in the late 1990s.

Conclusion

The conclusion, then, is simple: An index will grow, whereas the leading shares will be replaced over time.

And that’s probably the best way to look at it for your investment: If you are planning long-term and hope for steady gains for decades, perhaps for retirement, then invest in a stock market index.

If you believe in a specific company, then you may wish to invest in it. But beware that what goes up doesn’t always stay there.