Explore the Risks and Rewards of CFD Trading

KEY TAKEAWAYS

- CFD or Contract for Differences is an agreement between a buyer and a broker to profit from the difference in the bidding and the final value.

- The total investment costs include separate opening and closing commissions, financial charges for long positions, and interest accrued on the number of days on holding the asset value.

- The rewards to trade CFD depend on the detailed evaluation and market trading experience.

- The risks may be higher because of the lack of government regulations and the broker’s credibility.

Making a profit through CFD trading is all about high-risk management. Though it is used by experienced traders, learning about market volatility can give you higher rewards.

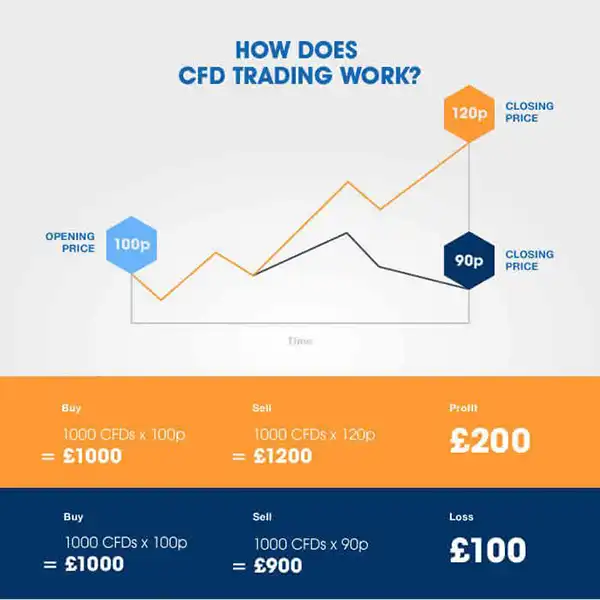

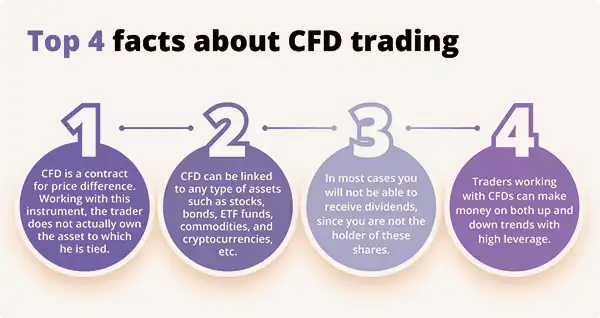

CFD or Contract for Differences is an advanced trading strategy. The buyer invests short-term on a financial product without owning the underlying assets. The trader makes money when the stipulation of either profit or loss is in his favor.

One of the ways that CFDs are successful is from ‘spreads’, which is the difference calculated between the selling price and the buying price. Traders need to closely monitor the price movement to identify the risks and rewards.

Let’s explore this article for details of the profit and loss involved in CFD trading to trade CFDs, click here

TABLE OF CONTENTS

How To Trade CFDsThe Total Investment Costs of CFDThe Rewards of CFD TradingThe Relative Risks of CFD Trading

How to Trade CFDs?

For CFD trading, an investor registers a contract with a broker to exchange the difference in the value of an asset between the time of the opening and closing of the deal.

There is no delivery of physical goods or securities with CFD. The investor earns profit because of the sudden price change of that asset.

The Total Investment Costs of CFD

To trade CFDs, a separate commission for opening and closing trades has to be paid to the broker. The trading of forex pairs and commodities may not require an initial percentage, but the brokers will ask for a commission for stocks.

A financing charge is incurred when investing in a long position (for weeks or months). It is because there are separate overnight holding charges on an asset. An interest rate is levied for the number of days a trader holds the position for an investor.

The Rewards of CFD Trading

Higher Leverage

CFD is most sought after for trading despite its high-risk probability because it gives higher leverage.

The biggest deciding factor in trading in CFDs is the lack of ownership of the underlying assets. Traditional trading is subject to government regulations and liquidity. A lower margin of capital investment means a higher chance of profitability.

Global Market Access from One Platform

The CFD brokers provide global market products on one platform, allowing investors around-the-clock access.

No Strict Borrowing Rules

Some markets have specific rules for borrowing the instruments, and that too with varying short- or long-term positions. However, there are no borrowing costs in CFD because of the lack of ownership of the physical product.

No Extra Fees

In CFD trading, brokers provide many options to stop trading as per the requirements of the trader at any time. Brokers make money from the spreads as mentioned earlier, and therefore have more freedom to modify the fees.

EXPERT ADVICE

If you see the price movement of your asset suddenly changing, your CFD broker can make a margin call. In the meantime, you can top up your initial margin to cover your losses and wait for the market trend to improve.

No Day Trading Requirements

There are no restrictions on the number of day trading in CFD. Accounts can be opened for as little as $1,000, although $2,000 and $5,000 are common minimum deposit requirements.

Variety of Trading Opportunities

Currently, the brokers offer the investors stock, index, treasury, currency, sector, and commodity CFDs. Therefore, traders have diverse financial options to grow their profits.

The Relative Risks of CFD Trading

Traders Pay the Spread

Where there are higher risks, there are chances of higher profit or loss. The rate of commission on entry and exit is the first phase of CFD trading. While paying for the spreads is necessary, if there is a higher loss, it hardly compensates for any small profit stipulation.

If you haven’t assessed your loss variability and risk management strategy, it could result in a devastating loss.

Lack of Strict Regulation

All the international markets aren’t strictly regulated, which makes CFD a high-risk trade. Your entire investment decision depends on the broker’s credibility. It requires experience with independent background checks before opening an account.

The trader has the advantage of stop-loss limits, but they don’t guarantee any return margin from a loss. In a pre-recession era, competition for a demanding asset can suddenly turn profit into bigger losses than expected.

Conclusion

Understanding the risks and rewards of CFD trading is intimately related to market volatility. While some argue that there are equal risks in traditional trading, there are ways to manage risk levels after careful monitoring of price movement. Your preferences and abilities should always be in mind, along with following a good trade strategy.