What to Consider When Opening a Forex Trading Account in Malaysia

The forex market is becoming more compelling for people across the globe. It is no wonder that people in a burgeoning economy like Malaysia are interested in turning toward this market to increase overall wealth.

The foreign exchange market offers lucrative opportunities for keen traders who study the data, patterns, trends, and fundamentals to gain an advantage.

However, interested individuals must ensure to set everything up in a proper fashion to conduct their forex trading. Indeed, this includes signing up with suitable brokers depending on the respective country in which one resides.

In this article, we will discuss what considerations traders should make when getting started in the forex market in Malaysia.

Search for the Ideal Broker

The first step on your journey is setting up a trading account in Malaysia is to search and opt for the right broker. The ideal one will vary based on the individual trader and his/her respective needs.

The dealer will provide a brokerage account, and this enables traders to fund their account and make trades. While traders may have preferences for agents, all must ensure certain criteria when selecting the right person.

The first relevant element is to ensure that the Securities Commission of Malaysia fully regulates the preferred dealer. The entity must also have a license from the respective central bank of the nation so that it meets basic compliance requirements.

Thankfully, there are several well-known entities that provide services in the region. It is here where you can also identify the best forex brokers with no deposit bonus and other aspects that you may desire.

DO YOU KNOW?

Forex trading was once only possible for banks and institutions with at least $40 million to $60 million in liquid funds. Today, people with a much smaller sum can engage in forex trading.

Set Up Your Account

After deciding on your brokerage partner, you must proceed to set up your account. This part of the process is straightforward.

It entails going to the agent’s site, registering by inputting your credentials, filling out generally requested information, and conducting basic know-your-customer processes.

In this Know-Your-Customer process, upload the requested government IDs and other relevant paperwork for the dealer to meet their compliance requirements.

The dealer may take some time to review and then send an email confirming your account setup is complete.

Transfer Funds to the New Account

The next step is to ensure you have the proper amount of funds to begin your forex trading endeavors.

When funding your account, remember that you must account for USD or Ringgit transfers. Most brokers have a minimum amount to put funding, this varies from as little as $15 to a higher amount like $600.

It is here where you undoubtedly want to understand how long it takes to transfer funds, how quickly the dealer will process it, and the various fees associated with your account. Remember that well-known agents are transparent with this information.

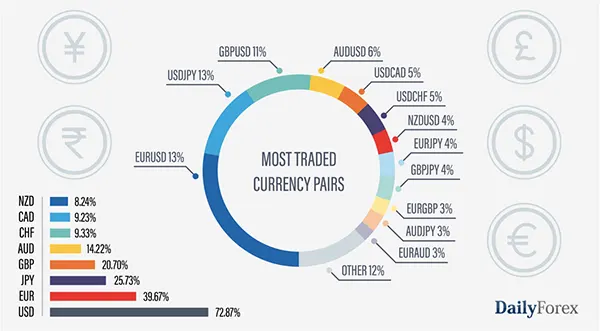

The chart below shows that the most traded currency pairs are the Euro and the USD. These factors matter a lot when managing a forex trading account.

Set Up Your Trading System

The next significant step is to set up the trading system the broker offers. These trading systems will have the right tools, information, and settings to help you view the current state of the market and trade accordingly.

The country has a well-developed economic market and the Bank Negara Malaysia, the country’s central bank, regulates all financial institutions, including the forex trading services.

There are many dynamics to trading including regulations which means traders should thoroughly research any broker before contacting them.

One relevant restriction that the Bank Negara Malaysia has imposed is that traders are not allowed to trade on margin, and the maximum leverage that can be offered by dealers is 1:30.

Despite governing laws like these, Forex trading is expanding its reach in Malaysia attracting potential high returns.

You also need to ensure you have your trading principles and plan in place to increase your chances of success in the forex market. If you are an international trader, then be aware of the time zone. The time in Malaysia from 9:00 pm to 1:00 am is one of the busiest times to trade because the New York and London forex markets intersect with each other.

There are market fluctuations for currencies such as USD, GBP, and EUR, and most traders prepare ahead of their trades to predict the market openings.

Trading forex in Malaysia for higher profits is a great idea and opening an account is easier with an experienced broker. However, it requires a lot of hard work, analysis, risk management, timing, and more to succeed in the industry.