Factoring Age Into the Reverse Mortgage Equation

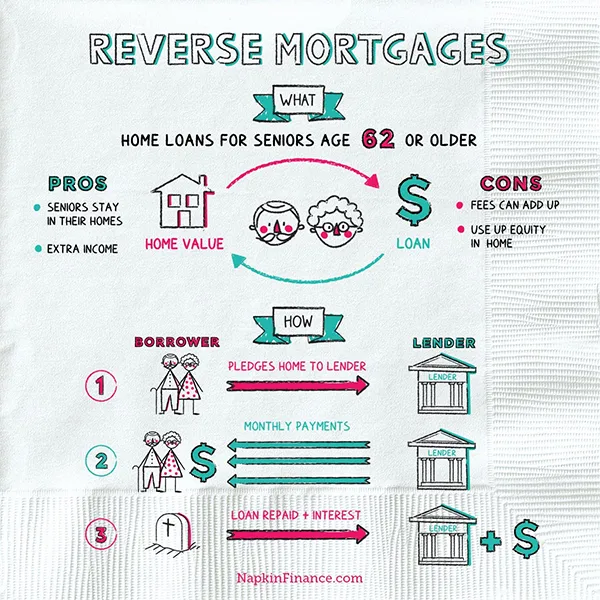

As you near the end of your working days, you are facing a decline in income. While there are several financial paths you can take, reverse mortgages stand out as a distinct tool for those aged 62 years or older, offering a unique way to unlock supplementary streams of income for retirement.

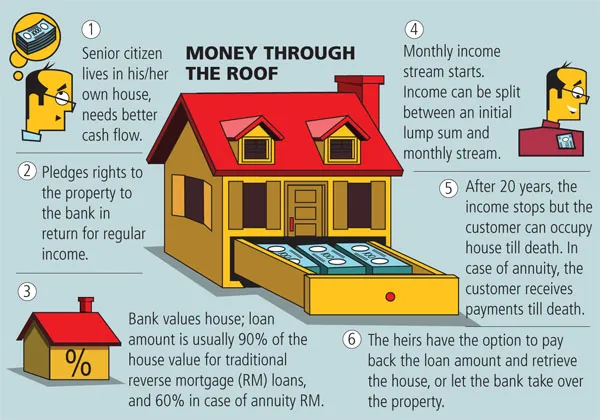

At its heart, a reverse mortgage is a means for homeowners to transform their home equity into a sustaining flow of funds. This marks a departure from the conventional mortgage where you make monthly payments to the lender. Here, the roles are reversed: the homeowner gets regular payments from the lender based on their deal.

In the United States, with its rapidly aging population understanding the nature of reverse mortgages is of utmost importance. The year 2024 alone is set to witness approximately 12,000 people each day reaching the age of 65. And if you’re one of them, by examining the benefits and potential drawbacks, you can make wise choices that solidify your financial position for retirement.

Let’s dive into this guide to conquer the sometimes-tricky world of retirement finances and discover how reverse mortgages might chart a course to a secure and rewarding future.

Age Requirements: Setting the Minimum Bar

The age of 62 opens the door to unlocking your home equity a minimum age for accessing a federally insured HECM reverse mortgage, which shields your home value by letting interest build up steadily.

It’s important, however, for potential borrowers to seek advice from financial experts, thoroughly research their options, and choose a lender known for their integrity and transparency. The landscape of lenders is diverse, but it’s important to take out a loan from a reputable lender such as Mutual of Omaha. Obtaining a Mutual of Omaha reverse mortgage loan can offer tailored financial options to suit individual needs. This approach helps in finding a solution that provides personalized support and clarity throughout the process.

Beyond the Minimum: How Age Impacts Loan Amounts

Reaching the minimum age for a reverse mortgage isn’t just a checkbox but also a key element in unlocking the potential financial benefits these loans offer. This potential is defined by principal limit factors (PLFs), which determine the maximum amount you can borrow based on your home’s value and your age.

The older you are, the higher your PLF. As you’ve had more time to build equity in your home and accrue interest on the loan. So, your age effectively increases the chances you can extract from your property.

Think of it this way: reaching the right age opens the door to this financial tool, while it boosts the amount you can access. It’s about using a specific financial instrument strategically to tap into your home’s value.

Did You Know?

In 2021, the federally insured reversed mortgage bounced back close to pre-pandemic times but remained below its peak a decade earlier.

Strategic Timing: Optimizing Your Reverse Mortgage Decision

Now comes the interesting question: should you jump at the larger loan available at your current age, or can you wait to reap further benefits? While accessing funds earlier with a larger loan provides immediate financial relief, waiting could mean securing a higher maximum amount later. But here’s the catch: waiting also means paying compound interest on the outstanding loan balance, potentially reducing your future debt proceeds.

Ultimately, the optimal timing depends on your circumstances and financial goals If you need immediate assistance in accessing a smaller debt now might be the best option. While securing additional funds now may seem tempting, considering your current budget might be advantageous to wait for a larger debt ater. This allows time for further financial preparation and ensures you secure the optimal loan amount for your needs.

Beyond Age: Additional Factors in Loan Eligibility

Getting a reverse mortgage isn’t just about age. You also need:

- Significant home equity: You need to own at least half of your home’s value outright.

- Mandatory counseling: Understand the deal! Take HUD-approved counseling before applying.

- Tax obligations: Keep property taxes and homeowner’s insurance current.

- Good financial standing: Ensuring you have the means to pay for the origination fee and upfront mortgage insurance premium.

- Primary residence requirement: Most reverse mortgages are for your primary residence, not vacation homes.

These rules help ensure you can handle a reverse mortgage, keeping things safe for both you and the lender.

Financial Implications of Early vs. Late Reverse Mortgage Use

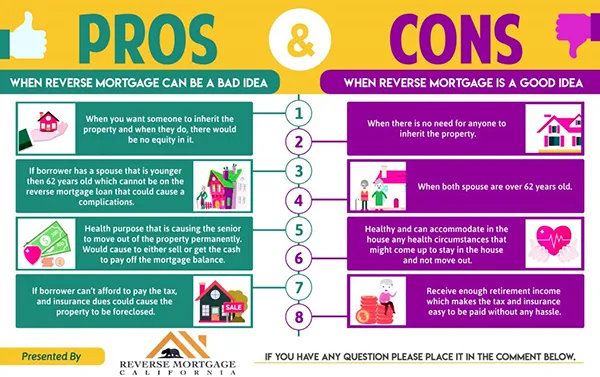

Using a reverse mortgage earlier or later can have implications beyond the immediate financial benefit. For instance, accessing funds early might affect your future Social Security benefits, as certain income thresholds can trigger reductions. Conversely, waiting can impact estate planning, as the outstanding loan balance reduces the total value passed on to heirs.

These are complex aspects worth discussing with a financial advisor who can assess your circumstances and guide you toward the most advantageous approach.

Conclusion

While age unlocks the door to reverse mortgages, it’s just the first step. Responsible choice lies in aligning your age with careful financial planning. Weigh your goals, understand the impacts, and choose wisely. By navigating this landscape thoughtfully, you can transform a reverse mortgage from a simple key into a strategic vessel for a secure and calm future.