The Ultimate Guide to Getting an Instant Personal Loan Online

Need cash fast? Look no further than getting an instant personal loan through online lending apps. It may seem too good to be true but in this digital age when businesses are condensed into a mobile, getting a personal loan is possible without any hassle.

The requirement can be varied from admission to a top-ranking university or purchasing a new car. Getting the convenience of borrowing from a legit lender is now easier because of online banking facilities. At the same time, securing your private data needs a constant check for easy withdrawal and disbursal.

From understanding what qualifies you for borrowing funds to searching for the best lender for your needs – follow our steps to get your money in minutes! Don’t wait any longer – start your ultimate guide to getting an instant personal loan today!

What is an Instant Personal Loan?

An instant personal loan is an unsecured loan that can be obtained quickly, often within hours or a few days. Unlike traditional lending, you don’t need to provide collateral or go through a lengthy approval process. This makes them a convenient option for addressing immediate financial needs.

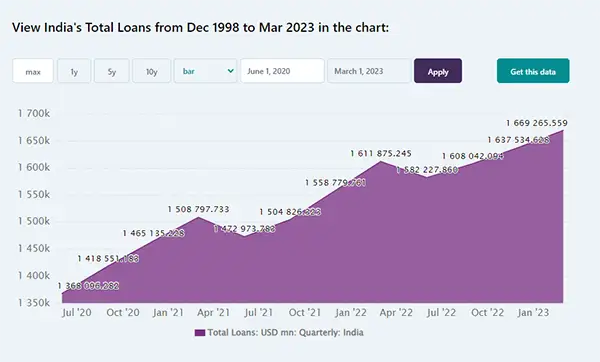

There is a constant growth in people applying for loans in India from December 1998 to March 2023.

The graph is an indicator of people’s trust in banking facilities as well as spending habits. Instant personal loans help bridge the gap by maintaining a good financial balance even during a recession or inflation.

Steps to Get an Instant Personal Loan

Getting a personal loan online is an easy process if you have a good credit history. It needs several basic checks of identification, and documents, and then match your financial profile with your respective bank. Here are the significant steps to get an instant loan online:

- Download the App: Download a reputable online lending app from your smartphone’s app store. There are varied options available, so choose one that suits your needs and has positive user reviews.

- Registration: Once you’ve installed the app, create an account by providing your basic information, such as your name, contact details, and identification documents.

- Eligibility Check: Most lending apps have an eligibility checker that lets you determine if you qualify for a loan. This step usually involves verifying your credit score and financial history.

- Loan Application: You can complete a loan application after determining your eligibility. You’ll need to specify the lending amount and repayment terms that suit your requirements. Most of the time, the repayment should coordinate with the banking facility for usage and a balanced distribution of funds.

- Document Upload: The app will prompt you to upload necessary documents, such as your ID, proof of income, and bank statements. Make sure to submit clear and accurate documents to expedite the process.

- Approval and Disbursement: After your application is submitted on the online loan app, it will review your information and perform a quick credit check. If everything points towards a positive financial ranking, you can expect approval and fund disbursement into your bank account quickly.

Tips for a Smooth Loan Application

There are many things considered for a positive loan application. The banks want to confirm that they are lending to a trusted person who will be able to repay the debt in the assigned time.

The individual has the liberty to choose from a number of payment options but for quick approval submitting the personal loan application correctly is vital.

Here’s how you can get your application approved quickly:

- Ensure that you provide accurate information and complete documentation to avoid delays or rejection.

- Borrow what you need and can easily repay to avoid falling into a debt trap.

- Read the terms and conditions carefully, including interest rates, repayment schedules, and additional fees.

- Make timely repayments to maintain a good credit score and increase your chances of getting approved for future loans.

EXPERT ADVICE

You can maintain a good credit score by paying your dues on time, upgrading to automated payments, reducing the number of credit cards, and not exceeding 30% of card usage.

Advantages of Instant Personal Loans through Online Loan Apps

There are various advantages of getting an instant personal loan online that could complete your requirements without the burden of a heavy mortgage.

- Speed: These credits are incredibly fast, providing you with the funds you need in no time.

- Convenience: You can apply from anywhere, without the need for in-person visits to a bank or lending institution.

- No Collateral: Instant personal loans are unsecured, meaning you don’t have to put up assets as collateral.

- Flexible Terms: Many online lending apps offer flexible repayment options to suit your budget.

- Build Credit: Repaying an instant personal loan can positively impact your credit score.

Conclusion

When you need quick financial assistance, an instant personal loan through an online lending app could be a lifesaver. Remember to choose a reputable app, provide accurate information, and borrow responsibly to make the most of this convenient financial tool. You can address your immediate financial needs with ease and peace of mind with the right approach.

What is the average loan amount to avail?

There are various factors that impact your credit score that determine your loan approval. From travel loans, home renovation loans, and education loans, to name a few. Besides that, your financial management history and lending habits are also checked. Your credibility also depends on your job and financial status.

The first assessment should be done by the borrower with a comfortable repayment time. Calculate your monthly, quarterly, or yearly EMI and borrow small amounts that can be repaid quickly.

What are the documents required for instant loan application approval?

Provide complete and correct documentation of identification and financial reports. Only borrow a small amount that could be repaid in easy EMIs. Read the terms and conditions of the lender carefully to avoid any extra loss or paying higher interest rates.