Leveraging Data Analytics in Mobile Copy Trading: Making Informed Decisions

In the realm of advanced tech and mobile applications, the clash of today’s latest technology with the world of the financial market has brought about a new way of making investments.

In this article, we will get into the characteristics of data analytics in copy-trading apps for mobiles and also emphasize the importance of making informed decisions when putting your money on the line.

We also get to know how the best online forex brokers use data-driven insights to improve the overall trading experience for their investors.

The Power of Data Analytics in Mobile Copy Trading

These mobile copy-trading apps make use of record analytics to give their customers a look into the complex world of trading, like the latest market trends, dealer performance, and investment opportunities.

Data analytics allow traders to make informed decisions by giving them a deeper understanding of the dynamics influencing the financial markets.

The use of statistics and analytics in mobile copy trading is not simply a technological improvement. Instead, it is a strategic tool that allows customers to skirt through the complexities of the financial market.

DID YOU KNOW?

According to Finance Magnates, 93% of futures traders and 82% of spot traders using copy trading made a profit. Bitcoin (BTC) was the most commonly traded asset using copy trading, followed by Ethereum.

Key Data Analytics Features in Mobile Copy Trading Apps:

- Performance Metrics: Many copy-trading apps give their users overall performance metrics, allowing them to analyze the historical achievements of buyers that they want to copy. This statistics-driven method allows investors to assess the record and consistency of performance before making any investment decisions.

- Risk Management Tools: Data analytics play a necessary role in developing robust risk management tools within mobile copy trading apps. List features, along with danger scores and volatility signs on potential trades, as well as some of the trader’s previous failures, can help the users avoid the potential risks of losing money. Some online brokers use these features to enhance the safety and protection of their portfolios.

- Market Trends Analysis: And, with the data analytics function in the copy-trading apps, users can analyze the market trends in pretty much real-time. By processing large amounts of market data, these apps allow their users to learn about real possibilities and risks, help them be one step ahead of the market, and cash in on some pretty awesome investment opportunities.

- Trader Sentiment Analysis: Some of the more premium copy-trading apps can add sentiment analysis to their dashboards. This allows investors to gauge the mood of the market and avoid making investment mistakes. Understanding trader sentiment can help investors predict market trends and make decisions that are more in line with broader market opinion.

Choosing the Best Online Forex Broker with Data-Driven Insights

Collaboration between mobile copy trading apps and the top online forex brokers can help increase the advantages of data analytics in making informed funding decisions.

So, when picking a web forex broker, it’s necessary to take note of all the features that they provide, like statistics, analytical insights, and the tools for the trade available to the users.

Aside from exceptional online foreign exchange broking platforms, they must also include a platform that seamlessly integrates with mobile copy trading apps and gives their users a comprehensive suite of analytics to enhance their trading strategies.

Unlocking the Potential of Data-Driven Investing

The inclusion of data analytics into the mobile copy trading apps gives the users a pretty innovative way of trading as compared to traditional investment techniques.

By using a more systematic and trend-based pattern for choice-making, investors can use these insights to take advantage of the opportunities to benefit from a competitive area within the marketplace.

This aligns their trading strategies with the complex understanding and know-how of market dynamics.

Many of the top online forex brokers know the benefits of data analytics and actively contribute to the success of buyers by creating an environment where statistics-driven decisions aren’t simply encouraged but are needed.

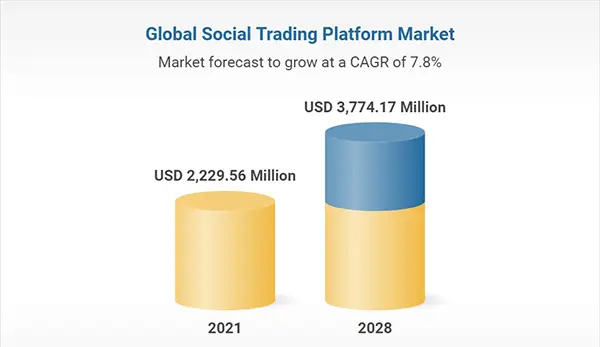

Global Copy-Trading Market Size

The global copy-trading platform market size is expected to grow from $2.22 billion in 2021 to $3.77 billion by 2028; it is estimated to rise at a CAGR of 7.8% between 2021 and 2028.

Conclusion

As mobile copy trading continues to redefine the landscape of financial markets, the role of data analytics becomes increasingly central to making informed investment decisions.

The combination of innovative mobile copy trading apps and online forex brokers creates a setting where data-driven insights allow buyers to glide through the world’s financial markets with confidence.

In an era of technological growth, using data and analytics isn’t always just a choice. It is a tool to help unlock the total capability of mobile copy trading and ensure a strategic and informed approach to investment decisions.