Key Differences Between Construction Loans and Mortgages

Purchasing your own home may be one of your biggest financial goals. However property tends to be expensive, so in most cases, you will need to take out a loan from a bank or a registered money lender. For home buying, two common types of loans are mortgages and construction loans.

These loans serve similar purposes, but they have key differences. Here are more details about mortgages and construction loans, how they’re different, and what each one can be used for.

Mortgage

A mortgage is a loan you use to help you purchase an already-built home. Loan tenures for mortgages are usually long – in Singapore, mortgage tenures range from 10 to 35 years. If your mortgage tenure is longer, your monthly repayments are smaller, though interest rates may be higher.

You may also use your CPF savings to help pay for your monthly mortgage installments. Follow the application process that you can find on the CPF Board website to find out how to do this.

Organizations and individuals use mortgages to purchase real estate without paying the complete amount upfront to the seller. The borrower party pays the amount with interest until they own that property.

The person who wants to purchase a home on the mortgage has to contact one or more mortgage lenders. The lender will ask for the evidence to decide your capability of repaying the loan.

Following are some of the main types of mortgages:

- Fixed-Rate Mortgages

- Adjustable-Rate Mortgage (ARM)

- Interest-Only Loans

- Reverse Mortgages

Construction loan

A construction loan, as the name suggests, is used to finance the construction of a new home. Most of the time, these loans are given to building contractors, and there is a disbursement schedule that follows the different phases of the construction project.

This way, the builders are guaranteed the funds they need for every step of the project.

Once the house has been completely built, the loan gets converted into a regular mortgage. The advantage here is the interest rate tends to be lower than if you take out a mortgage loan from the outset.

Usually, these are short-term loans of around one year until the construction of the house is completed.

When the period of the construction loan is over, the borrower can refinance the loan into a permanent mortgage or apply for a new loan to pay the previous one.

Most lenders ask for a minimum 20% (even 25% in some cases) down payment at the time of loan.

Interesting Facts

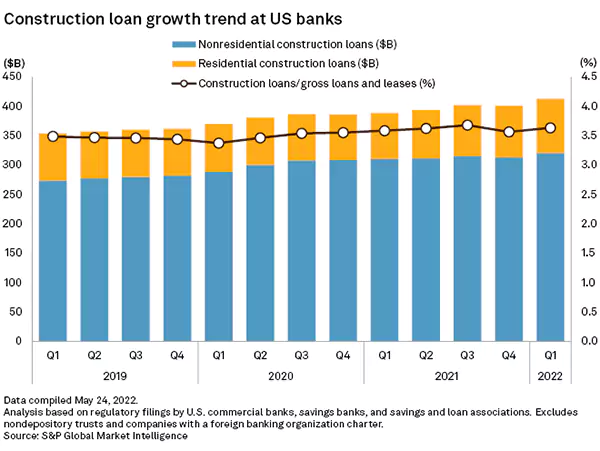

The above graph shows the data on the growth trend of residential and non – residential loans at US banks. The number of Nonresidential construction loans increased by 2.3% in the first quarter to $320.45 billion.

Which is better?

Both types of loans have their merits depending on the kind of property you wish to purchase. If it’s already built, like an HDB flat or EC, you will have to apply for a mortgage. Construction loans cannot be used for properties that are already built.

On the other hand, if you own land and do not have a house yet, a construction loan is worth considering. This will help you cover the high costs of building your home.

Construction loans tend to be more challenging to qualify for, though. For one, you will need to submit detailed building plans from your contractor to the bank. Also, banks tend to be stricter with the qualifications for construction loans.

DO YOU KNOW?

Almost 88% of Americans take out a mortgage when it comes to buying homes. The interest tax deduction of mortgages has been around since 1894.

You can use your CPF savings to help pay for both kinds of loans, but there are more limits set for construction loans. More documentation is also needed when applying to use your CPF savings for a construction loan.

These include building plans, a valuation report of your property, a complete breakdown of costs from the contractor, a temporary occupation permit, and letters of offer from the bank.

If you apply to use your CPF savings to pay off a mortgage, there is no need to submit building plans or cost breakdowns, as the property is already built to begin with.

You can also set aside a higher amount from your CPF OA account to pay for your monthly mortgage installments than you can with construction loans.

Conclusion

Choosing either a construction loan or a mortgage depends on the property you aim to purchase. If the property is already built, you will need to apply for a mortgage to fund your purchase.

But if you own land and want to build a house on it, you can opt for a construction loan. Once the house is complete, the loan will be converted to a regular mortgage.