Automated Trading Platforms & Copy Trading: How Busy Professionals Can Invest with Ease

Key Takeaways

- Finding the right investment options to increase wealth can be overwhelming for a working professional.

- With copy trading, you can replicate the tips and strategies of an experienced trader.

- Platforms like automated trading allow you to execute trades at high speed with precision.

- The combination of these two can be a game changer in the growth of your seed capital.

Are you struggling to build a perfect crypto investment strategy?

As a working professional, finding the time and energy to monitor your investments actively seems impossible. Luckily, combining a copy trading strategy with an automated trading platform allows you to access a wealth of investment knowledge and proven strategies without needing a steep learning curve.

Here’s what you should know.

Copy Trading Explained

Copy trading is a blissfully simple concept with proven results. Instead of organically growing your operation strategy (mistakes included), you can replicate the activities of experienced and successful traders whose risk profiles and strategies align with yours.

The source trader is often called a ‘master trader’ or ‘signal provider.’ It is often lumped under the social trading banner, as many of these sources also foster a supportive environment where tips and tricks are shared, and you can monitor the performance of the signal provider’s portfolio in real-time.

Do You Know?

Based on projections, the copy trading market is expected to be valued at $80 billion by 2025.

What is an Automated Trading Platform?

Also known as ‘algorithmic’ or ‘trading bots’, they are software programs that execute your chosen operation strategies based on the predefined rules and algorithms you set.

These platforms allow you to fully automate your buy and sell orders, making it possible to trade in financial markets at any time of the day without your direct intervention. They have become popular in recent years as they can execute trades at high speeds and with consistent precision.

Reuters suggests that trading bots could drive between 70%-80% of daily trades. No matter where you typically invest-the indices, crypto, Forex, or commodities- there will be an algorithm to match.

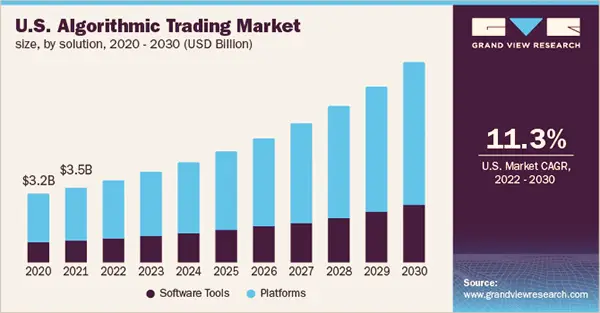

In 2021, this market stood at $15.55 million and is estimated to reach at a CAGR of 12.2% from the period between 2022 and 2030.

Why Copy Trading and Automated Trading Platforms Go Seamlessly Together?

Now imagine what you can do with a combination of these two strategies.

If you have your operation strategy, you can simply program your automated trading platform with those rules and let it execute them. For example, if you decide on a specific dollar range within which you are willing to buy and sell to leverage Dollar Cost Averaging for your portfolio, you input those parameters, set them, and are done.

Suppose you have not had the time and experience to develop your market knowledge. In that case, however, you can choose a signal provider who matches your investment tactics and risk profile and use the algorithm to follow their market movements.

This lets you:

- Use their experience to create a passive investment strategy for yourself.

- This also allows for easy diversification outside your expertise, even when you have market experience. Don’t understand crypto? Use the strategies of someone who does!

- Replicating experienced traders is also a great way to learn the ropes and get used to the market with few errors.

- Trade at any time of the day, even when you are working.

- Gain social support and insider knowledge from like-minded traders.

Most of all, however, it lets you simplify and automate trading, removing the time investment you don’t have to spare and another key element- emotion. When emotion becomes involved in trading decisions, it can distort your risk/reward perceptions, cloud your judgment, or lead to unfavorable trading outcomes. This effect can be more pronounced for inexperienced traders.

With a skilled hand-making decision and a smart bot ensuring you stick to the plan without doubt and worry, you can ensure this rookie error never plagues your portfolio.

You need only two things for a successful passive investment strategy with copy trading and automated platforms. That’s a reputable way to evaluate and vet signal providers, usually through a trusted online platform and marketplace. And an understanding of your risk tolerance– remember, even a fantastic value signal provider will not be good for you if you prefer growth strategies.

If you’ve always told yourself you’re too busy to learn to invest, think again. Copy trading and executing trades through automatic trading platforms lets you invest confidently and easily, getting proven results to boost your wealth.