How AI and Automation Are Transforming the World of Proprietary Trading?

Proprietary trading is when a financial firm or a bank uses its money, instead of the clients, for investing in stocks, bonds, mutual funds, or other securities. It is a high profitability market and with the advent of AI and automation, has revolutionized the trading ecosystem.

With fully automated software, traders can easily analyze, execute, and manage their marketing strategies. It allows algorithms to predict stock deals with better execution for a higher success rate.

This article delves into understanding how leveraging automated systems for proprietary trading has helped achieve efficiency, accuracy, and profitability.

Market Analysis Empowered by AI

AI innovations has empowered every prop firm to analyze vast amounts of stats accurately. In the past, traders would spend hours manually collecting and analyzing market information, often leading to missed opportunities and suboptimal decisions.

With AI, trading algorithms can process volumes of real-time data from sources like news feeds, social media platforms, and financial statements. These reports are then scrutinized for patterns and insights that enable traders to identify stock transaction opportunities confidently.

Moreover, AI-powered algorithms possess adaptability as they continuously learn from market conditions, enhancing their performance over time.

For instance, machine learning algorithms can scrutinize information to uncover patterns and trends that human traders might have overlooked. This allows the algorithms used in trading to predict stock movements, significantly improving the success rate of trades.

THINGS TO CONSIDER

In prop trading, business firms can build an inventory of securities with the help of AI to equip them for any sudden liquidation of the market when trading becomes difficult in the open market.

Automated Trade Execution

Automation has completely transformed how trades are executed in stock transactions. By the input of orders into successful trading options, dealers use automation to handle market execution on their behalf.

These systems are designed to follow established rules and instructions, making them faster and more efficient than human traders.

Automated trading processes can swiftly execute trades by responding to real-time transaction conditions. This eliminates delays and ensures that deals are executed at the most favorable prices.

It also minimizes errors as deals are carried out based on predetermined parameters, eliminating biases that can impact decision-making.

Risk Management and Compliance

The integration of AI and automation has brought about advancements in risk management and compliance within trading. With algorithms in place, processes can now monitor financial conditions and automatically adjust positions to mitigate potential risks.

For instance, if an algorithm detects volatility in a stock, it can automatically decrease exposure or exit the position entirely. This empowers business firms to manage their risk exposure while avoiding losses effectively.

In addition, AI-driven software can also monitor stock activities to ensure adherence to requirements. These systems can detect irregularities or possible violations by analyzing trade data and patterns, empowering firms to take measures.

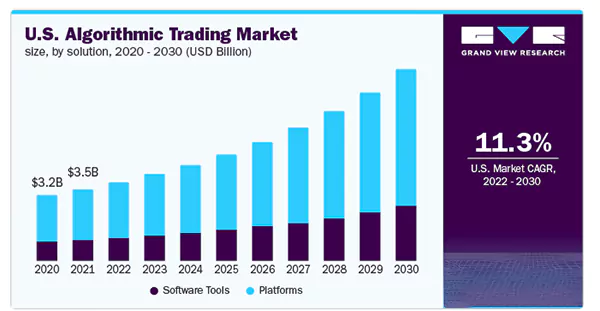

Investors are adopting the AI-based model for trading solutions for accurate predictions and gaining better profits for their valuation. This trend is predicted for exponential growth till 2030 as shown in the graph below.

Improved Alpha Generation

The integration of digitization has significantly bolstered the capacity of business firms to generate alpha, which refers to returns exceeding a benchmark or market average. Through AI-powered tools and automated trading software, dealers can effectively identify and exploit financial inefficiencies.

These advanced systems can rapidly analyze amounts of data and process complex mathematical models. Executing deals accordingly enables firms to seize opportunities and achieve higher returns.

Moreover, AI algorithms facilitate high-frequency trading—a technique involving trades executed within fractions of a second to capitalize on short-term market fluctuations. Such rapid data processing capabilities and automated execution would be nearly impossible for traders.

With technological advancements, high-frequency trading has become an avenue to profit from the slightest price movements.

Looking Ahead

The future of trading is anticipated to witness a growth in the influence of AI and automation. Technology will become more advanced enabling them to analyze data accurately and provide precise predictions. Automation will also become prominent as more transaction tasks are delegated to machines.

While the demanding role of computerization in stock marketing may raise concerns about job displacement, it’s necessary to remember that these technologies are designed to enhance dealers rather than replace them entirely.

Traders will continue to play a role in developing strategies, managing risks, and making decisions. Technology and computerization will serve as tools augmenting these activities and enabling traders to achieve outcomes.

Conclusion

In summary, the world of market transactions has been revolutionized by the advent of AI and automation. These technologies have empowered dealers with tools, fast execution capabilities, and improved risk management systems.

Consequently, proprietary trading firms can attain efficiency, accuracy, and profitability levels by hiring professional engineers. As technology advances further, we can expect the impact of AI and automation to continue growing, transforming the landscape of trading more profoundly.