Essential Guide to Due Diligence in Coin Listings

The current technology that we are witnessing is the most advanced tech that humans have experienced yet. Still, the industry is continuously developing and witnessing innovations. Similarly, one of such innovative sectors in this industry is the crypto sector.

The world of cryptocurrency has always been a fascinating place to explore. It has a lot of technicalities and the key functions are always evolving. However, some of you might think cryptocurrency is all about buying and selling those coins. But in reality, it’s a whole different realm that you do not know about. The whole process starts with coin listing on exchange where the currencies are listed.

This stage consists of analyses, due diligence (or audit), evaluation, and safeguarding potential risks and challenges. Therefore, this write-up is intended to give you all the information about coin listing and how it is done.

Factors that Contributed to Due Diligence

When in the stage of due diligence or audit, the currency is evaluated on numerous factors. Based on the performance in the respective factor, the coin has been given its deserving spot. Those factors are listed below:

- Legal Compliance and Considerations: Since cryptocurrencies are deeply associated with money and cannot be tracked due to their decentralized nature, there is some legal compliance on which a coin has to stand so that it does not get involved in any unethical practice. Some examples of such compliance are Anti-Money Laundering (AML) and Know Your Customer (KYC).

- Transparent With Government Authorities: As mentioned earlier, it has to be made sure that cryptocurrencies are not used for the wrong. To maintain the trust between the makers of the coin and the authorities, the policies and terms & conditions of the currency have to be transparent with the system.

- Use Case and Utility: This is the stage where it is evaluated where the currency would be used in the practical world. This evaluation or analysis allows the exchange to determine and focus on the potential problems and their solution.

- The potential of the Technology: During the time of due diligence, some limitations are set for the technologies used in the development of coins. The intent for such limits is to only list those currencies that have potential in their development and that can sustain the maximum change or risk.

- Track Record and Historical Performance: Just like in our daily lives, the past is considered the mirror of the present, similarly, cryptocurrencies are also judged based on their past performance. There are several algorithms and techniques on which the further potential growth of a coin is determined. Help from machine learning and advanced AI tools is also sought to make a judgment.

- Market Demand and Competitor: The market is the ultimate factor that has to be taken into consideration. If the demand for a particular currency is high in the market, the listing of that currency becomes easier. Along with demand, competition also plays a key role.

These were some of the major factors that have their key influence on the listing of a particular cryptocurrency. Based on these decisive points, a coin is judged.

Fundamental Evaluation of the Project

During the process when a coin is being audited by the exchange, the sites mainly focus on the white paper of the project.

White Paper: According to Investopedia “A white paper is an informational document issued by a company or not-for-profit organization to promote or highlight the features of a solution, product, or service that it offers or plans to offer”.

Multiple elements in the white paper answer different questions related to the project. Those questions include:

- What does the project do?: It is the main focus of the project or the main issue that the whole work is intent towards. The answer has to be straightforward, and every reader reading the white paper must learn the main cause of the project.

- Reason for it getting developed: After the issue that is being targeted, the reason is stated in the white paper. It is somehow related to the previous question, but the issue is addressed in more detail.

- How will the project help in solving the issue?: After determining the concern, it is then asked what help the project can provide to overcome the problem. In this case, a currency is expected to answer how it is going to build its unique identity or make its place in such a competition.

- Details of the Team: Then in the next section of the white paper, it gives information about the team that is responsible for the functioning of the project.

DID YOU KNOW?

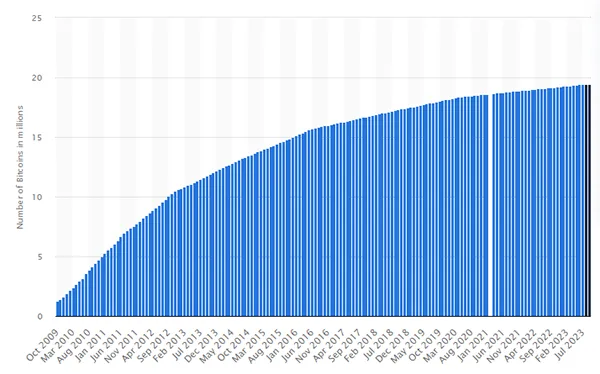

According to Financebuzz, “An interesting Bitcoin fact is that when the protocol for the Bitcoin network was set up, the limit was set at 21 million coins. As a result, at some point, no more new bitcoins can be created by cryptocurrency miners.”

Conclusion

Due diligence is the stage where the coin is evaluated, analyzed, audited, and judged before getting listed. There are several factors involved such as Legal Compliance and Considerations, transparency with Government Authorities, The potential of the Technology, etc.

Also, another paramount stage in the process consists of evaluating the whole white paper of the project. The white paper carries information regarding all the details of the project and its intent.