How Can You Incorporate Your LLP?

As businesses are rapidly growing worldwide, many owners are looking for more viable ways to collaborate and work in partnerships.

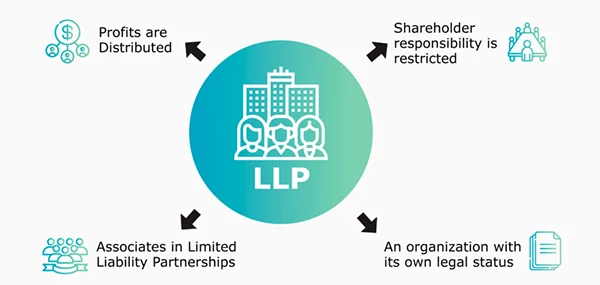

An LLP or Limited Liability Partnership is one such hybrid form of legal entity that incorporates the benefits of a partnered firm and a company.

This concept was introduced in India under the LLP Act 2008 between two organisational bodies. Any change in the collaboration between the two parties does not affect its existence, rights, or liabilities.

In this type of agile business entity, some of the partners can have a limited liability like that of shareholders based on the agreement.

This article provides information about the characteristics, requirements, and the entire process of incorporating a Limited Liability Partnership.

Characteristics of LLP

To understand the way limited liability partnership works take a look a its following characteristics:

- An LLP exists as a separate legal entity, distinctly different from the partners. For taxation, it is treated like any other partnership firm.

- To start an LLP there is no requirement for minimum capital and it has perpetual succession.

- A minimum of 2 partners are required and there is no upper limit on the number of partners. No partner is accountable for the unauthorized actions of another partner. The collaborators are shielded from the joint liability created by another partner’s misconduct.

- In this, an audit is not a mandatory requirement and it has to be conducted only if the contributions exceed Rs. 25 lakhs or if the turnover exceeds Rs. 40 lakhs.

Requirements for Incorporation of An LLP

To incorporate/register an Limited Liability Partnership, you will have to fulfil these requirements:

- The LLP should have a minimum of 2 partners – individuals and companies or LLPs.

- The minimum number of individual designated parties should be 2 and one of them has to be an Indian resident and one of the collaborators should have the authorization.

- All the parties should have a PAN card, DIN (Directors Identification Number) and DSC (Digital Signature Certificate). The designated partner will need a DPIN (Designated Partner Identification Number).

- All the designated partners should have a DSC (Digital Signature Certificate). They need to obtain a Class 2 or Class 3 DSC from the authorised certifying agency.

- The Limited Liability Partnership should have a registered office.

THINGS TO CONSIDER

LLP formation is not allowed for non-profit objectives and purposes.

Process for Incorporating An LLP

The process for incorporating/registering an Limited Liability Partnership can be done online as follows:

- You can go to the Ministry of Corporate Affairs (MCA) portal and fill in the registration form. Input your username and password and upload your digital signature.

- Decide the name of your proposed LLP and it should end with Limited Liability Partnership. Fill up Form 1 with up to 6 choices of names. Either the partners or the designated ones can submit the Form 1. Sign the forms electronically using DSC.

The name you picked should not match the existing names of any company, LLP or trademark. You can search for existing names on the MCA portal, which provides you similar or closely resembling names of existing companies/LLPs.

- Once you have decided on the name, you can go ahead and fill the Form 2 for integration of your LLP and pay the prescribed fees.

- Provide the details of two designated parties who have DPIN. The e-form will have to be signed electronically by the designated partners.

- On submission of all the required documents the Registrar of Companies (ROC) will check them. If the application is compliant with all the provisions of the Act then the Registrar will issue a Certificate of Incorporation. Within 14 days you can get the certificate and check the status of the registered application online.

You can do the registration process online or approach a company that offers LLP registration services. When you approach a company you can fill out and submit a form online. Their experts will get in touch with you to complete the legalities and within 15 days your LLP will be registered.

In conclusion, incorporating Limited Liability Partnership is highly profitable for SMEs and startups. This business entity is not just a passing trend in India but has been accepted worldwide.

Countries like the UK, U.S. Australia, Singapore, and many gulf states are offering its opportunities to help startups and entrepreneurs establish themselves.

With the legal registrations and the entire process made simpler, companies can avail its benefits to do business confidently.