How to Find the Best Credit Card for Your Financial Needs?

In today’s digital age, credit cards are no longer a luxury but a necessity. With a plethora of alternatives available in the market, opting for the perfect one can be tough. A card that suits your neighbor or friend might not be the best fit for you.

It’s significant to find an online payment method tailored to your financial needs and spending habits. If you’re a college student, a frequent traveler, or someone trying to rebuild their credit, the ease of transactions is greater with owning a credit card.

This article aims to guide you through a variety of payment options available and help you distinguish the best credit cards to help you make an informed decision.

Understanding Your Financial Needs

Before diving into the transaction information, take a moment to understand your budget needs and habits. Are you someone who pays off the full balance every month, or do you carry a debt? Do you travel frequently? Or are you looking for help to build your credit score? Answering these questions will give you clarity and narrow down your options.

For instance, if you’re someone who pays off their balance every month, you might want to opt for an online payment method that provides rewards or cash back. On the other hand, if you tend to carry an incurring amount, you might want to choose a card with a low annual percentage rate (APR).

Research Different Types of Cards

Once you have a clear understanding of your needs, it’s time to familiarize yourself with the different types of cards available. Here are some of the most common categories:

- Reward Cards: These offer rewards in the form of cashback, points, or miles. They can be a great choice if you’re looking to earn something extra on your purchases. However, these often come with an annual fee, so ensure the benefits outweigh the cost.

- Balance Transfer Cards: If you have high-interest debt on one or more credit cards, a balance transfer card can be an excellent option. They allow you to transfer the amount from your high-interest ones and often provide a zero percent introductory APR for a set period.

- Travel Cards: For the frequent traveler, travel cards offer perks like airline miles, hotel stays, and other travel-related rewards. Some even provide travel insurance and no foreign transaction fees.

- Student Cards: These cards are tailored for college students and often come with low credit limits. They can be a great way to build spending and payment history while still in school.

- Secured Cards: For those with bad or no banking transaction history, secured cards can be a lifesaver. They require a security deposit, which often sets the credit limit. Over time, responsible use can lead to an upgrade to an unsecured card.

EXPERT ADVICE

Student credit cards may have higher APRs but they also offer perks and rewards like earning cash back for varied transactions.

Consider the Costs

While rewards and benefits are tempting, it’s necessary to look at the costs associated with online transactions. Annual fees, interest rates, balance transfer fees, foreign transaction fees, and cash advance fees are just some of the costs you might incur. Always read the fine print and understand the total cost of owning and using the card.

For example, a card might have incredible rewards but come with a high annual fee. If you’re not going to use it enough to justify the fee, it might not be the best choice.

Check Eligibility Requirements

Credit card issuers have certain eligibility criteria for their transactions. These might include a minimum credit score, income requirements, and more. Before applying, ensure you meet these criteria.

Each time you apply for a card, there’s a hard inquiry on your bank report, which can temporarily lower your credit score. Multiple applications in a short period can harm your credit, so choose wisely.

Read Reviews and Get Recommendations

Word of mouth and online reviews can be incredibly helpful. Friends, family, and colleagues might have insights about certain cards, their benefits, and potential pitfalls.

Online forums and review sites provide a wealth of information from real users. These can give you a clearer picture of real-world transactions and if they align with your needs.

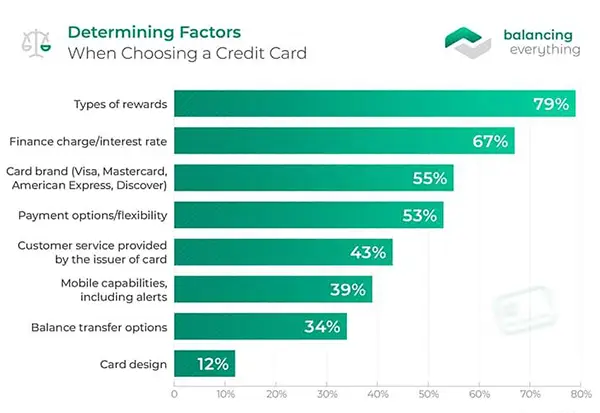

The graph below shows that the type of rewards a bank is facilitating is the biggest reason for users to opt for a credit card.

The Role of Credit Scores in Card Selection

Your transaction behavior plays a pivotal role in determining which credit cards you qualify for. This three-digit number, usually ranging from 300 to 850, represents your banking worthiness, and issuers use it to gauge the risk of lending to you.

A higher score typically indicates that you’ve managed your previous transactions responsibly and are less likely to default on payments.

When you possess a high credit score, you generally have access to cards with better rewards, lower interest rates, and more perks.

On the flip side, if your score is on the lower end, you may be limited to secured or subprime cards with fewer benefits and higher fees. It’s relevant to know where you stand before diving into applications.

Navigating the Maze of Terms and Conditions

Credit card agreements come packed with terms and conditions. These legal documents outline everything from interest rates to the various fees you could incur. While it might be tempting to skim through or skip reading them altogether, understanding these terms is necessary.

For instance, some banks might give a grace period, which is the time between when your billing cycle ends and when your payment is due. If you pay off the remaining amount in full during this period, you won’t incur any interest.

However, not all banks provide this, and it’s necessary to be aware so you can manage your payments effectively.

Credit Card Security and Protection

In a world where digital fraud is rampant, online security should be a top priority. Many cards now come with embedded chips for added security during in-person transactions. Moreover, many issuers include fraud protection, ensuring you won’t be held responsible for unauthorized charges on your account.

However, the onus of safeguarding your banking information also falls on you. Regularly checking your statements for suspicious activities, setting up transaction alerts, and keeping your card details confidential are steps you should always follow.

Some of them also provide additional security features like virtual card numbers for online transactions, ensuring your actual card number remains undisclosed.

Think Long Term

While it might be tempting to opt for a card that has an incredible signup bonus or introductory offer, think long-term. Will it still be beneficial after the introductory period?

Does it align with your long-term financial goals? It’s always wise to choose a card that will be a good fit not just now, but in the years to come.

Making the Right Decision

In the varied world of credit cards, the perfect match requires a blend of introspection, research, and foresight. Remember that your financial needs are unique, and what works for one person might not work for you.

Understand your spending habits, be aware of the associated costs, and always think long-term. With careful consideration, you can find a payment method that not only meets but enhances your banking well-being.

Conclusion: Your Financial Tool for the Future

Credit cards are powerful financial tools, but their potential can only be unlocked when used wisely and chosen with care.

By understanding your needs and thoroughly researching your options, you can find one that becomes a valuable asset in your financial journey.

Always remember that the right credit card can be a gateway to economic freedom, but the responsibility of using it wisely lies in your hands.

- Understanding Your Financial Needs

- Research Different Types of Cards

- Consider the Costs

- Check Eligibility Requirements

- Read Reviews and Get Recommendations

- The Role of Credit Scores in Card Selection

- Navigating the Maze of Terms and Conditions

- Credit Card Security and Protection

- Think Long Term

- Making the Right Decision

- Conclusion: Your Financial Tool for the Future