Home Warranty Tips for a Better Choice

Home warranties can be beneficial to both buyers and sellers alike; it’s necessary that both do their research before making their decision to purchase or sell one.

It is recommended to begin your research by investigating plans, companies, and customer reviews prior to creating a list of needs and comparing quotes.

Therefore, to make it a bit easier for you, here are a few tips to help select the ideal one offered by Cinch Home Warranty Solutions.

Read the Contract

Home warranty companies sometimes sell plans that do not fully cover what was promised, which can prove expensive in the end.

Be sure to carefully read your contract, paying close attention to exclusions, extra fees, and coverage limits as well as cancellation and renewal terms.

Many companies provide sample contracts online that can assist when determining if a warranty is worthwhile for you. Moreover, your real estate agent or previous occupants of the house could be an excellent source of information on any warranties in effect for the house.

Several residence warranties also offer “à la carte” options that enable you to add coverage for specific systems or appliances; this may be tempting to budget-minded homeowners; however, keep in mind that extra cost will likely increase premiums accordingly.

Ask Questions

Home warranties can provide immense value, yet are far from perfect. A good warranty company should serve the interests of its clientele rather than vice versa; thus it is imperative that earlier signing any contract, all terms, and conditions are fully understood by you before entering into an agreement.

Compare pricing and coverage limits to find the ideal option for you. Besides, inquire if you can select your own repair person, instead of leaving this decision up to your provider.

Prior to choosing any provider, it’s necessary that you ask how they vet their contractors and if there is a system in place to block out those that don’t perform as promised. Asking this question can save both you and the provider time and effort, as well as even money in the future.

Get a Quote

Home warranties can be invaluable investments for any homeowner, especially when buying or selling a new one. They also serve to cover systems or appliances that have begun breaking down in advance of their manufacturer warranties expiring or when building contracts expire on new-construction homes.

When picking a warranty provider, ask for quotes and compare pricing, coverage terms, reviews, and contracts with clear terms, clauses, and exclusions, as well as Better Business Bureau ratings of A or A+. Also, try to avoid companies that have low BBB ratings or received complaints from state officials; these could be warning signs they aren’t being honest with regard to their contracts.

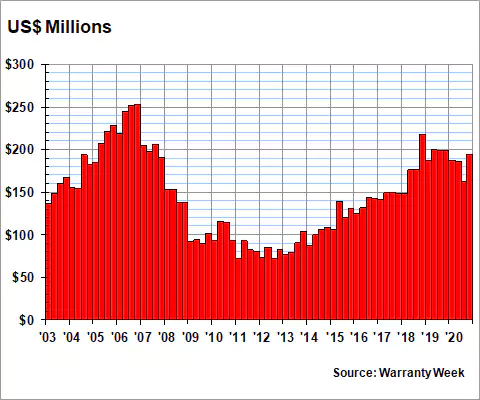

This above-cited graph shows the Homebuilding warranty claims Paid per Quarter by U.S.-based Builders (in US$ millions, 2003-2020)

According to a report by WarrantyWeek.com, “In the third quarter of 2020, new home builders spent just $163 million on claims, down -18% from the same year-ago quarter. And it was the steepest drop of the year, surpassing the -7% drop in the second quarter and the -2% drop in the fourth quarter of 2020”.

Do Your Research

These warranties can be an invaluable resource for buyers, sellers, and existing homeowners who wish to safeguard their investments. When researching companies for purchasing one, be sure to read testimonials, reviews, and BBB ratings; besides, check for complaints against them from state attorneys general.

Also, keep in mind that there will usually be a waiting period as your coverage commences, giving you time to make an informed decision. Once your research has been completed, it’s advisable to obtain quotes from multiple companies, compare coverage, cost, exclusions, and sample contracts, and then choose one with qualified contractors and an excellent reputation.

Make the Right Decision

These warranties often receive negative publicity as being scams or unnecessary add-ons when selling homes, but when properly researched and considered, they can provide valuable coverage against unexpected repair bills. By gathering quotes and carefully reading contract details, homeowners can ensure they make an informed decision regarding any warranty coverage agreements purchased.

The warranties offer first-time homebuyers, or those stretching their budget in search of their dream place, peace of mind against costly repairs and replacements.

Existing homeowners who can’t afford an emergency fund and prefer professional maintenance may find them particularly valuable – just make sure you consider each plan’s coverage caps, service-call fees, and deductibles carefully before signing on!

The top warranty companies typically have clear contracts with clearly outlined terms, conditions, and exclusions; so there won’t be any unpleasant surprises down the road.