Top Digital Banking Transformation Trends for 2024

As the world continues to grapple with the impact of the Covid-19 pandemic, it’s become evident that almost every industry has been influenced, and the ways of doing business have been transformed. The FinTech industry is no exception, with banks taking steps to adopt new banking software development solutions, digital technologies, and business models in order to keep up with changing market trends.

Geniusee is a trusted tech provider with deep expertise and extensive experience in digital banking development. We offer innovative solutions for our clients to ensure up-to-date approaches and outstanding outcomes. To better understand how you can conquer the banking industry in 2024, it is essential to review the latest trends and consider how they might impact the development of digital banking products such as mobile banking apps. In this article, we will explore key trends and their implications for the future of banking.

Top Trends in Digital Banking

Open and Transparent Banking

Research shows that trust is a top concern for consumers when choosing financial products. To build trust, banks need to prioritize transparency in their operations. It means being open and honest with customers, communicating the truth, and accepting mistakes. Focusing on transparency can help banks stand out in a competitive market, as seen with Monzo, a UK-based app-based bank with over five million users.

Data-Driven Personalization

Big data, AI, and machine learning are making it possible for financial institutions to offer personalized services to their customers. This goes beyond just using customers’ names and encompasses understanding their likes and dislikes to create personalized banking solutions. Accenture reports that 74% of consumers find “living profiles” with more detailed personal preferences helpful in creating personalized experiences. Banks can use it to offer personalized banking solutions

AI and More Focused Services

The current trends in digital banking suggest the use of AI-powered bots in real-time to gather customer preference data. This information, combined with advanced analytics, can be used by financial marketers to deliver personalized experiences. With AI, banks are better equipped to deliver targeted services and create more effective marketing strategies.

Cloud Computing

Cloud computing has seen a major surge in the digital banking industry trends. This involves accessing computing services such as data warehouses, software, and networking tools over the internet.

The banking industry is expected to experience a major shift towards cloud computing in 2022 due to its numerous benefits, including:

- Cost-effectiveness

- Global scalability

- Improved productivity

- Faster processing speeds

- Adequate security measures

- Reliability

- Convenience

Automation Efficiency

Many companies and banks still rely on manual data work, leading to a burden on upper management to oversee these tasks instead of strategizing.

Automation can revolutionize internal business processes in banks by allowing managers to make decisions based on data analysis without manually producing reports. This gives time for other important tasks and reduces costs through increased efficiency and streamlined processes.

As automation becomes more prevalent in the banking industry, traditional financial institutions are expected to adopt automated systems for tasks such as back-office services and customer support. For instance, using Optical Character Recognition (OCR) systems can eliminate the need for manual data entry, while Robotic Process Automation (RPA) can ensure error-free automation.

Uninterrupted Service

As digital banking usage increases, it is imperative for banks to maintain reliable servers and avoid any downtime. A single instance of system failure can harm the reputation and hard-earned credibility of the bank. For instance, the State Bank of India experienced significant financial losses due to a system outage. With over 16,000 financial transactions happening on their platform hourly, every moment is critical.

Security and Privacy

The relationship between banks and theft is a long-standing one. As digital banking becomes more prevalent, customers are increasingly vulnerable to the risk of financial loss. This has led to a growing demand for robust cybersecurity measures among digital banking users.

A survey by CSIweb revealed that:

58% of people would discontinue using a financial institution’s services if they experienced a breach of their privacy.

28% of surveyed customers reported that their bank accounts had been compromised by a cyber attack at some point in their life.

Speed and Agility

Speed is a crucial factor in the banking industry, as businesses require quick and efficient decisions from their banking partners. However, a survey by McKinsey showed that 59% of banks struggle with slow systems due to a lack of cross-functional collaboration.

Banks need to improve their bureaucratic processes and increase their speed in order to gain a competitive edge. Quick decision-making and efficient fund channeling are becoming essential for businesses, requiring banks to be fast and responsive.

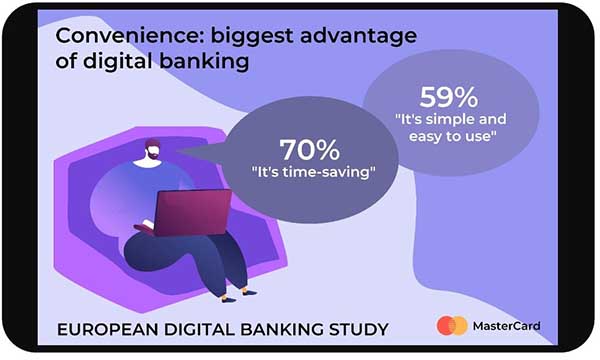

Focus on Usability and Simple Design

In the digital era, a user-friendly and intuitive design is essential for any service. Customers prefer mobile banking apps with a wide range of features over those with limited functionality. They want to see visually appealing graphics, infographics, and interactive modules, not just boring Excel sheets. As a result, we can expect banks to improve their mobile apps and websites with new features and functionality in 2024 and put a higher focus on digital design rather than the physical appearance of their branches.

Visualization is Critical for Competitiveness

The current generation values visualization in their daily routines, making it a crucial aspect for digital banks to stay competitive. User experience plays a vital role in financial institutions’ success. Digital banking must create visually appealing systems to keep customers engaged and focused. In the future, we can expect the emergence of more visually stunning, appealing, and trendy mobile banking apps. Banks will invest heavily in creating innovative apps that provide enhanced user experiences and functionality to meet customer demands.

In conclusion, the advancements in technology are driving banks to adopt digital transformation. The COVID-19 pandemic has accelerated the shift towards digital banking, as individuals and businesses increasingly rely on it in their daily operations. The banking industry undergoes major changes, as banks adopt innovative technologies such as AI, cloud computing, and machine learning to stay competitive.

At Geniusee, we assist companies in utilizing these digital banking trends to gain a competitive advantage. Contact us for support if you are considering implementing digital banking solutions or developing an online bank. Our expert team is here to help you employ the most recent innovative approaches and build highly demanded products. We are open to challenges and know how to turn them into opportunities.