How Blockchain is Transforming the Landscape of Low-Cost Remittances

The development of innovative technologies like Blockchain has led us to a new era of financial transactions across different countries. One of the most significant aspects of cross-border commerce is remittances for foreign workers.

Remittances typically mean transferring money from a distant land to family members to support their economic status. While there have been traditional methods of money order and even banking, they incur service and convenience fees from middlemen.

To counter the high-cost impact on the sender and the receiver, Blockchain technology is a valuable alternative that could transform the remittance landscape. It promises to be affordable, and fast and provides robust security.

The Pain Points of Traditional Remittance Methods

Since time immemorial, people have been utilizing traditional remittance methods to manage financial transactions.

In a 2022 survey, it was found that approximately one billion people are involved in remittances which is valued at more than USD 600 billion. It involved currency exchange rates of over 6% on average.

Although online money transfers contribute greatly to stabilizing economies and poverty reduction, the sending agents require additional charges for their services with security issues.

High Fees

Transferring big amounts to another party is valuable for a worker to aid his family members. It may not be surprising, that for smaller remittances that are under $200 a poor migrant will incur a 10 percent which far exceeds his average income.

High transactional fees are a major factor that requires more diligence from banks like PayPal which are accepted internationally for payments.

Slow Processing Times

The traditional methods of international wireless transfer of money can take up to two business days. This slow processing becomes a hindrance for those who want to aid financially during natural disasters.

Security Concerns

There are varied ways to exchange money but with online hacking pervading industries and even banks, individuals require robust software.

Technical knowledge does not come easily to every worker and therefore it increases the chances of security breaches and losing funds in the remittance process.

THINGS TO CONSIDER

A universal wallet across homogeneous and heterogeneous blockchains is proposed after a recent survey to facilitate fast and inexpensive remittance services.

The Blockchain Revolution

Blockchain is still considered a new entrance in the financial sector but it is being readily used for cryptocurrency. Its usage is not just limited to investing in stocks and trades. Cryptos as the virtual currency ensure safe transactions.

Reduced Costs

The Problem

Major banking facilities have been trying to reduce the remittance fee by encouraging workers to open a bank account. However, sometimes the hidden charges and interest rates may cause problems and create a rather complex system of transferring funds.

The Blockchain Solution

By using Blockchain, individuals can avoid the middlemen agents, processing fees, and other hidden charges. It conveniently sends remittances without any hassle improving savings for the present as well as for the future.

Speed

The Problem

It is difficult to manage tradings when you cannot assess the overall time for the monetary transaction. The anticipation of receiving money safely could also lead to incurring debt or late fees.

The Blockchain Solution

Blockchain is the ultimate solution to speed as it can be tracked and reached in real-time. It is a completely transparent service that could be utilized efficiently for big or small amounts.

Enhanced Security

The Problem

As more and more workers go to work in another country for better job prospects, sending funds home could be fraught with risks. From sending agents to hackers interrupting online exchanges, there is always a threat that your transaction could be compromised.

The Blockchain Solution

As Blockchain is expanding its reach in various sectors, utilizing it for remittance is much more secure. It is decentralized and every transaction is recorded and viewed. This makes it difficult to spot any fraudulent activity and take immediate steps to reverse it.

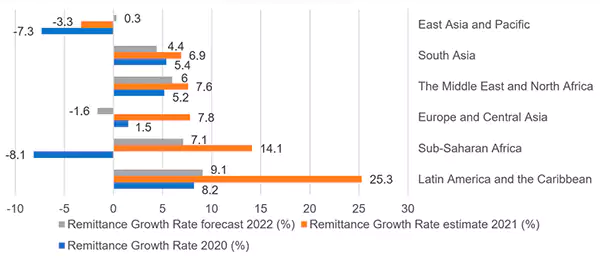

The number of workers across nations are diverse that are involved in the remittance industry with Latin America and the Caribbean leading the trend as seen in the graph.

Real-World Applications

Blockchain is a revolution as it is cost-effective, transfers funds faster, and is secure. The latest technology is yet to be explored more as banking facilities are also competing to improve their facilities.

For someone who sends money regularly, blockchain is transforming the entire process of remittance, making it convenient and less complex. For example, Klever offers a blockchain-based platform that enables quick and low-cost international funds transfers.

By using Klever, users can send money across borders without the need for a traditional bank, thereby saving on fees and time. For additional information, visit klever.org and discover all the potential Kleverchain use cases.

The Future of Remittances

In a world with economic uncertainties and political upheaval, sending funds across borders is a challenging task. With blockchain technology, workers can manage transactions at their end while tracking money in real time.

There are yet many digital landscapes to explore especially with the growing online threats risking losing funds. Virtual transfers require robust security with advanced software like AI and loT creating a safer remittance solution.